Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

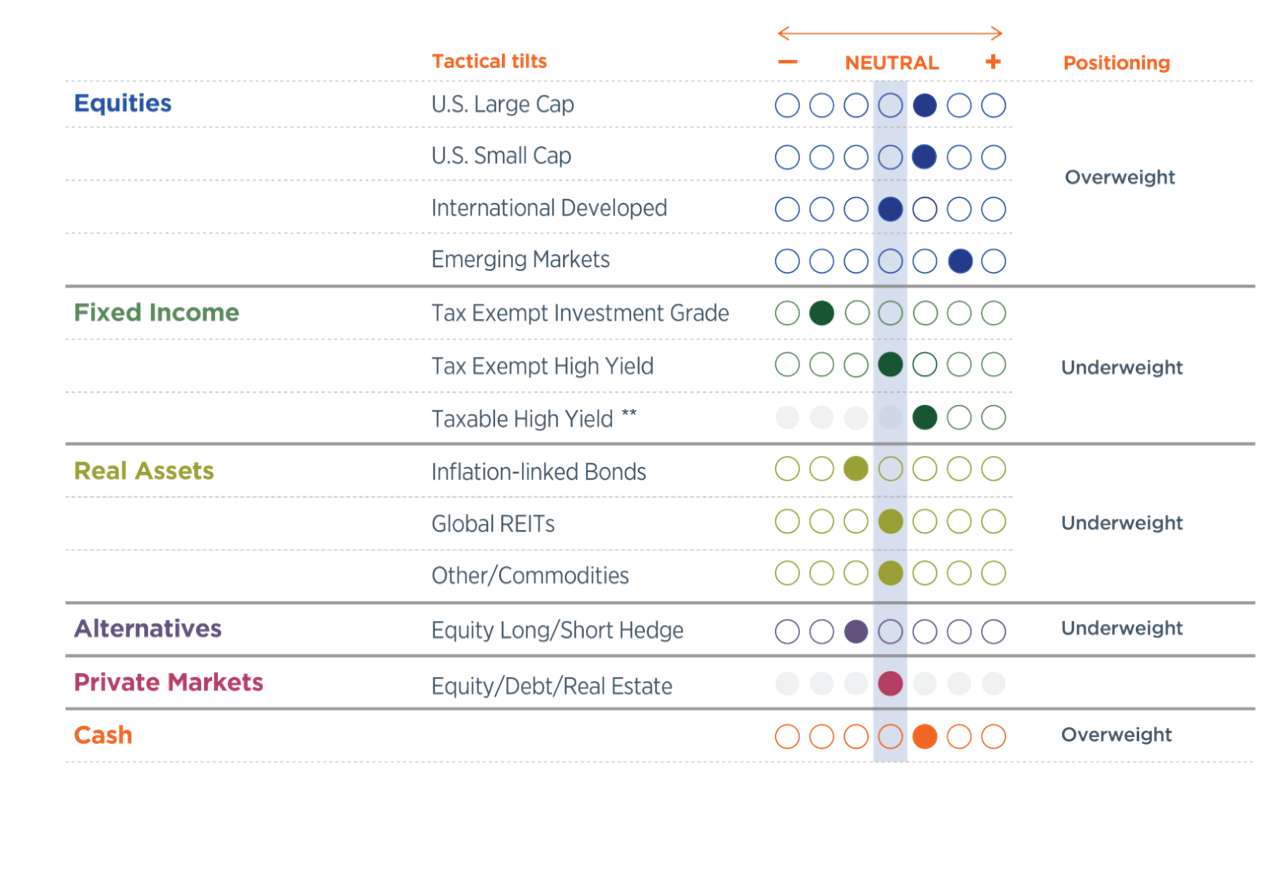

March 4, 2022— The horrors unfolding in Ukraine are deeply upsetting on every level. As investors, it is our job to separate emotions from facts that alter our 9–12-month view of the economy and financial markets. The situation in Ukraine has deteriorated at a rapid pace in the past two weeks, challenging some of our earlier assumptions and raising the risk of a more substantial impairment to economic growth in Europe. As a result, we are reducing our overweight to international developed equities to bring it in line with our benchmark, and raising our cash position. We retain a modest overweight to U.S. and emerging markets equities.

Reassessing Risks

On February 25, Wilmington Trust held a client webinar outlining our portfolio positioning and two key assumptions necessary to avoid a material downgrade of global economic growth:

Since last Friday, both of these assumptions have broken down, and we have adjusted portfolios as a result.

Over the weekend of February 26, the West united to unleash an unprecedented level of sanctions, including the removal of seven Russian banks from the SWIFT system (which provides services related to the execution of financial transactions and payments between banks worldwide) and sanctioning of the Russian Central Bank. These sanctions will cripple the Russian economy. Noticeably absent are any sanctions touching oil and gas companies or exports directly, as policymakers have recognized that restricting energy supply could be quite painful for consumers already reeling from the highest inflation in 40 years.

However, the risks of a supply disruption are rising. U.S. Congress is discussing banning imports of Russian oil, and such a move could prompt a similar response from other countries. Russia has also threatened retaliation for recently enacted sanctions, which could obviously include shutting off their spigots leading to a potential oil price shock (figure 1). Even without overt sanctions on Russian energy exports, there are numerous indirect ways in which supply could be disrupted, including through lack of financing, refusal of shipping companies to accept Russian product, destruction of infrastructure, or “self-sanctioning” by companies and countries. BP took less than a week to decide to pull its 20% stake in Rosneft, the state-owned Russian oil firm. Shell also moved quickly to cut ties with Rosneft, the Russian gas goliath. Although Western firms are still technically free to buy Russian output, there are reports of buyers balking, effectively reducing supply from Russia. OPEC may be willing to add production in the event of an actual supply disruption, but their existing relationship with Russia and modest spare capacity makes that calculus tricky. A deal with Iran could potentially add as much as one million barrels per day over a matter of months—by far the most meaningful opportunity to offset supply coming offline.

There are also increased risks to supply of the broader commodity complex. Our second assumption above posited that—one way or another—the conflict would be resolved over a relatively short timeframe and without complete destruction of Ukrainian infrastructure. Russia and Ukraine produce an outsized global share of many important commodities outside of energy, including wheat, iron, aluminum, palladium, and key semiconductor inputs like neon (Figure 1). With risks building that the war will be extended and with massive destruction to infrastructure, the impact on inflation and supply chains could be significant.

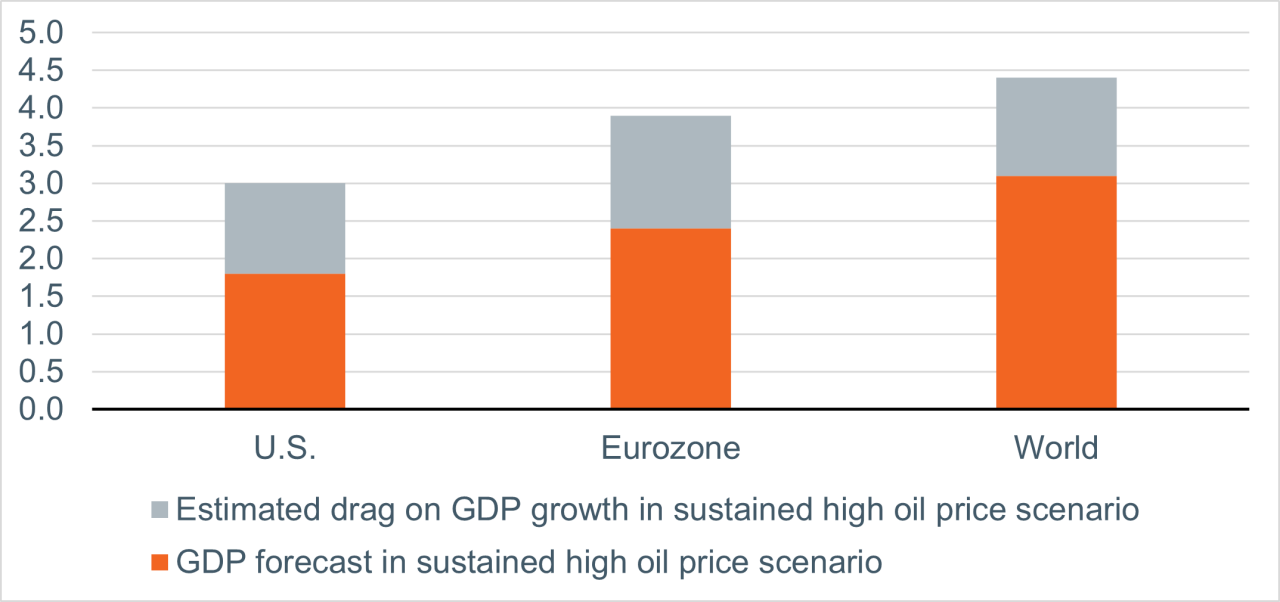

Figure 1: Impacts of an Oil Price Shock

Full year GDP impacts of a sustained increase in oil price in 2022 to $125/barrel for WTI and $134 for Brent

Source: Pre-war forecasts as of January 25, 2022, using WTIA forecasts for US, and IMF forecasts for Eurozone and World2

Revisiting portfolios on economic risks

The bottom line is that the price of Brent crude oil has already increased 47% year to date; the broader commodity complex has increased 28% over that same period.[1] The situation thus far has unfolded in a way few anticipated, and no one knows how it will be resolved. Putin has left himself isolated from the world and with few off ramps. What we do know is that the risk of sustained, higher commodity prices has risen considerably. This results in a downward revision to global growth, with Europe feeling the effects more dramatically.

Our analysis shows a material but not fatal hit to the economy under oil price shock scenarios. A sustained price increase to $125 per barrel in 2022 could drag on global GDP by -0.8% and would push inflation higher. Importantly, these estimated impacts are nonlinear and felt differently around the globe. Europe’s outsized reliance on Russian oil and natural gas, along with its geographical proximity and more intertwined financial system, poses greater risk to the growth outlook and possible spillover effects to consumer spending. In the U.S., such a shock could drag on U.S. GDP by -0.6% and drive inflation up by 0.9% relative to our current baseline. That would reduce U.S. growth to a still-sturdy 2.4% this year but push our estimate for year-over-year CPI inflation to 3.9% by end 2022. These larger-than-previously-estimated impacts come from a higher oil price, but the sustained nature is equally important. (In other words, prices need to increase and stay elevated to begin to erode economic growth.)

Europe entered the year on very solid economic footing and is set to benefit from fiscal stimulus later this year. A recession is not yet our base case, but the uncertainty posed to its economy over the next few quarters warrants a reduction of the asset class to neutral. We have taken the proceeds and added to cash, taking our cash holdings slightly above benchmark weight. Should the situation deescalate, we could redeploy that cash. Alternatively, a more severe commodity shock could cause us to reevaluate our current overweight to U.S. equities.

A quick word on portfolio exposure to Russia specifically: Many clients are rightfully concerned about their exposure to Russia’s equities or fixed income. Direct exposure to Russia in our clients’ portfolios is extremely small. Our recommended portfolios hold no direct exposure to Russian debt, and the little exposure to Russian equities is virtually all through our emerging markets equities allocation. In most client portfolios, we access emerging markets equities through one active manager and a passive vehicle. These implementations result in exposure to Russian equities of just 0.1% of the total equity allocation. (Total portfolio exposure will depend on a client’s risk profile and allocation to equities versus bonds, real assets, and private markets).

Importantly, those figures are as of February 28, 2022, and since that date, MSCI (a major benchmark index provider) has announced the removal of Russian equities from its Emerging Market Indexes. As a result, we expect these holdings to be sold from all passive implementation vehicles, as well as most active (as managers benchmarked to an index that no longer holds Russian equities will be unlikely to allocate to the country). The timing of this is uncertain, as capital controls and a closed Russian stock market make liquidation incredibly challenging at present, but we expect this reduced exposure to be reflected in the near future. Indirect exposure, for example through global oil producers owning a joint venture in Russia or European banks with exposure to Russian assets, is also limited, though more challenging to calculate and dependent on a client’s exact holdings.

Core narrative

The current geopolitical environment is extremely tense and uncertain. Risks have risen, but our base case remains that the global economy will continue to growth. We are reducing our exposure to international developed equities to a benchmark weight and increasing our cash positioning. We believe the U.S. economic outlook is still solid, and we are retaining a modest overweight to U.S. equities. Emerging markets equities also still present a constructive outlook, particularly as China is showing signs of easing policy to support growth. Commodity producers, such as Brazil, stand to benefit from higher commodity prices. We continue to evaluate the economic ramifications of the Russia-Ukraine war and will adjust portfolios accordingly.

High-net-worth portfolios with private markets*

Data as of March 3, 2022. Positioning reflects our monthly tactical asset allocation (TAA) versus the long-term strategic asset allocation (SAA) benchmark. For an overview of our asset allocation strategies, please see the disclosures.

*Private markets are only available to investors that meet Securities and Exchange Commission standards and are qualified and accredited. We recommend a strategic allocation to private markets we do not tactically adjust this asset class.

**Taxable high-yield bonds are not included in the strategic asset allocation benchmark for tax-sensitive portfolios primarily invested in municipal bonds. In this case, the Investment Committee saw an opportunity to invest in short-term, taxable leveraged loans (high yield) and Private Markets for both taxable and nontaxable portfolios.

[1] According to Bloomberg, with commodities represented by the Bloomberg Commodity Index.

[2] Estimated impact (grey section of bars) as of March 9, 2002, based on WTIA forecast of impact on GDP of 67% increase in oil price from $75/barrel at start of the year.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds. Any offer will be made only in connection with the delivery of the appropriate offering documents, which are available to pre-qualified persons upon request.

An Overview of Our Asset Allocation Strategies

Wilmington Trust offers seven asset allocation models for taxable (high-net-worth) and tax-exempt (institutional) investors across five strategies reflecting a range of investment objectives and risk tolerances: Aggressive, Growth, Growth & Income, Income & Growth, and Conservative. The seven models are High Net Worth (HNW), HNW with Liquid Alternatives, HNW with Private Markets, HNW Tax Advantaged, Institutional, Institutional with Hedge LP, and Institutional with Private Markets. As the names imply, the strategies vary with the type and degree of exposure to hedge strategies and private market exposure, as well as with the focus on taxable or tax-exempt income. On a quarterly basis we publish the results of all of these strategy models versus benchmarks representing strategic implementation without tactical tilts.

Model Strategies may include exposure to the following asset classes: U.S. large-capitalization stocks, U.S. small-cap stocks, developed international stocks, emerging market stocks, U.S. and international real asset securities (including inflation-linked bonds and commodity-related and real estate-related securities), U.S. and international investment-grade bonds (corporate for Institutional or Tax Advantaged, municipal for other HNW), U.S. and international speculative grade (high-yield) corporate bonds and floating-rate notes, emerging markets debt, and cash equivalents. Model Strategies employing nontraditional hedge and private market investments will, naturally, carry those exposures as well. Each asset class carries a distinct set of risks, which should be reviewed and understood prior to investing.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

References to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third-party trademarks and brands are the property of their respective owners.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today