Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

As the 2024 presidential election quickly approaches, changes in U.S. policy could bring new risks and opportunities for the economy and markets. At Wilmington Trust, our objective is to provide timely updates on the election to help clients make sense of the headlines and potential implications for their portfolios. While the platforms of both candidates have largely been communicated to voters, there is no guarantee new proposals will be enacted into law, increasing uncertainty. With less than a month to go until the election, investors have become more focused on the potential risks to their portfolios. Here, we aim to address some of the most common and pressing questions on the minds of our clients.

What are the potential implications of the election on debt and deficits?

How would each candidate’s proposed policies affect our view of inflation?

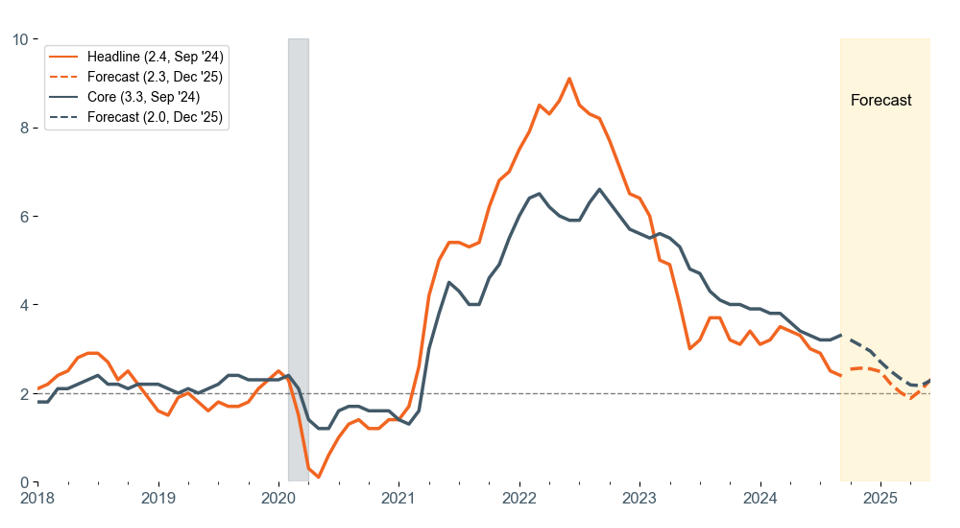

Figure 1

Headline CPI continues to make great progress, ticking down to 2.4% in year-over-year terms

Consumer Price Index (CPI) inflation and forecast (y/y% change)

Source: Bureau of Labor Statistics, Wilmington Trust. Data as of October 10, 2024.

Could a new administration affect prescription drug prices?

How are bonds expected to perform in the next few years?

How do you suggest investing with the market at all-time highs? Should we be sitting on extra cash?

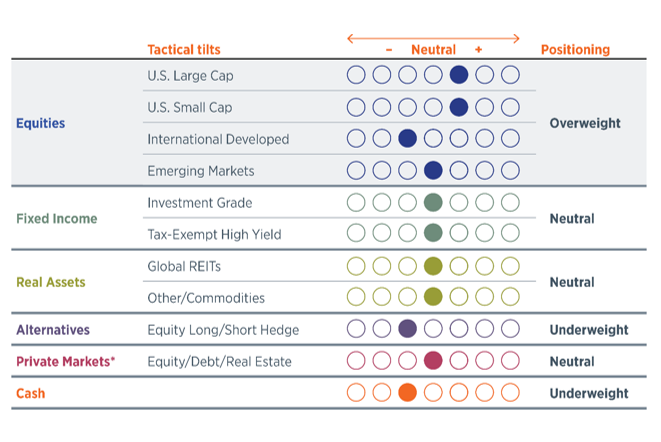

Figure 2

Asset Allocation

High-net-worth portfolios with private markets*

Data as of September 30, 2024. Positioning reflects our monthly tactical asset allocation (TAA) versus the long-term strategic asset allocation (SAA) benchmark. For an overview of our asset allocation strategies, please see the disclosures.

*Private markets are only available to investors that meet Securities and Exchange Commission standards and are qualified and accredited. We recommend a strategic allocation to private markets we do not tactically adjust this asset class.

Core narrative

The presidential election has shaped up to be a tight race, keeping policy uncertainty high. As policy paths narrow and we gain more clarity around the election outcome, we will continue to provide timely updates on potential economic and market implications. At this point, it is too soon to make firm conclusions. While changes to policy have the potential to affect the U.S. economy and markets, it’s just one of the many factors we consider when positioning portfolios. Macro dynamics, such as the Fed’s pivot to rate cuts, may play a larger role in how asset classes trade broadly and at the sector level over the medium to long term. Further, there is no guarantee that candidate platforms will be fully adopted or have the intended effect on the U.S. economy. We will continue to monitor election-related risks and opportunities as they evolve and provide regular updates on our current thinking as it relates to the markets and portfolio positioning.

[1] Michael Rainey, “CBO Raises Its 2024 Deficit Forecast 27% to Nearly $2 Trillion (yahoo.com),” Yahoo, June 20, 2024,

[2] “The Fiscal Impact of the Harris and Trump Campaign Plans-Mon, 10/07/2024 - 12:00 | Committee for a Responsible Federal Budget (crfb.org),” Committee for a Responsible Federal Budget (CRFB), October 7, 2024.

[3] Nik Popli, “Kamala Harris Rolls Out Economic Plan. Here's What's In It | TIME,” TIME, August 16, 2024.

[4] “Donald Trump's Suggestion to End Taxation of Social Security Benefits-2024-07-31 (crfb.org),” CRFB, July 31, 2024.

[5] Brett Rowland, “Trump's plan to offset tax cuts extension is 'highly uncertain' | National | thecentersquare.com,” The Center Square, October 3, 2024.

[6] Mark Zandi, et al, “assessing-the-macroeconomic-consequences-of-harris-vs-trump.pdf (moodys.com),” Moody’s, August 2024.

[7] Melissa Pistilli, “Harris vs. Trump: The 2024 US Election, Drug Prices and Healthcare (msn.com),” MSN, October 2024.

[8] Bruce Gil, “Kamala Harris' plan to keep prescription drug prices down includes a $2,000 cap on out-of-pocket costs (msn.com),” August 2024.

[10] “Harris vs. Trump: The 2024 US Election, Drug Prices and Healthcare (msn.com)”

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

CFA® Institute marks are trademarks owned by the Chartered Financial Analyst® Institute.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

An Overview of Our Asset Allocation Strategies

Wilmington Trust offers seven asset allocation models for taxable (high-net-worth) and tax-exempt (institutional) investors across five strategies reflecting a range of investment objectives and risk tolerances: Aggressive, Growth, Growth & Income, Income & Growth, and Conservative. The seven models are High Net Worth (HNW), HNW with Liquid Alternatives, HNW with Private Markets, HNW Tax Advantaged, Institutional, Institutional with Hedge LP, and Institutional with Private Markets. As the names imply, the strategies vary with the type and degree of exposure to hedge strategies and private market exposure, as well as with the focus on taxable or tax-exempt income. On a quarterly basis we publish the results of all of these strategy models versus benchmarks representing strategic implementation without tactical tilts.

Model Strategies may include exposure to the following asset classes: U.S. large-capitalization stocks, U.S. small-cap stocks, developed international stocks, emerging market stocks, U.S. and international real asset securities (including inflation-linked bonds and commodity-related and real estate-related securities), U.S. and international investment-grade bonds (corporate for Institutional or Tax Advantaged, municipal for other HNW), U.S. and international speculative grade (high-yield) corporate bonds and floating-rate notes, emerging markets debt, and cash equivalents. Model Strategies employing nontraditional hedge and private market investments will, naturally, carry those exposures as well. Each asset class carries a distinct set of risks, which should be reviewed and understood prior to investing.

ALLOCATIONS:

Each strategy group is constructed with target policy weights for each asset class. Wilmington Trust periodically adjusts the policy weights target allocations and may shift away from the target allocations within certain ranges. Such tactical adjustments to allocations typically are considered on a monthly basis in response to market conditions. The asset classes and their current proxies are:

• Large–cap U.S. stocks: Russell 1000® Index

• Small–cap U.S. stocks: Russell 2000® Index

• Developed international stocks: MSCI EAFE® (Net) Index

• Emerging market stocks: MSCI Emerging Markets Index

• U.S. inflation-linked bonds: Bloomberg US Treasury Inflation Notes TR Index Value Unhedged USD (took effect 8/1/22)

• International inflation-linked bonds: Bloomberg World ex US ILB (Hedged) Index

• Commodity-related securities: Bloomberg Commodity Index

• U.S. REITs: S&P US REIT Index

• International REITs: Dow Jones Global ex US Select RESI Index

• Private markets: S&P Listed Private Equity Index

• Hedge funds: HFRX Global Hedge Fund Index (took effect 8/1/22)

• U.S. taxable, investment-grade bonds: Bloomberg U.S. Aggregate Index

• U.S. high-yield corporate bonds: Bloomberg U.S. Corporate High Yield Index

• U.S. municipal, investment-grade bonds: S&P Municipal Bond Index

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today