Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

On November 5, American voters will head to the polls to elect the next U.S. president and their representatives in Congress. Vice President Kamala Harris and former President Donald Trump have each put forward a wide range of proposals covering taxes, spending, tariffs, immigration, and more—all of which could have implications for the U.S. economy. It’s important to note that while politics and policy are related, they are also different. What a candidate says they will do is not a guarantee of what they ultimately can or will accomplish once elected. Further, there remains a great deal of uncertainty around the control of the White House and both chambers of Congress; thus it is too soon to speculate on potential economic impacts.

While new laws and regulations can affect the performance of certain asset classes and sectors, it is the degree to which these policies impact the economy that matters most for positioning portfolios. We have an economics-led investment process and believe that macro factors are the primary drivers of returns over the medium to long term. Overall, we think the economic outlook remains supportive of U.S. equities for the next nine to 12 months, particularly given our outlook for slowing but expanding growth and a rate-cut cycle to begin in September. As we get closer to November and investors weigh election-related risk, we may see some additional market volatility. In this policy primer, we assess the issues that we believe will be most critical to the U.S. economy—specifically taxes, trade, and immigration—and draw broad conclusions around implications for the markets and investors.

Setting the stage

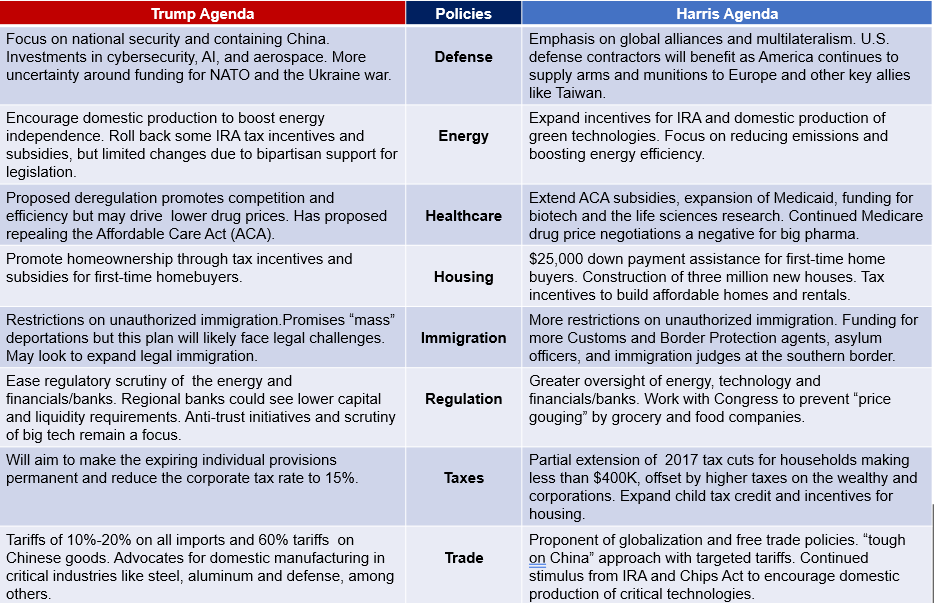

Trump and Harris have released key elements of their economic agendas (Figure 1). However, as platforms are still being refined and communicated, and election races are expected to be close, risks and opportunities for asset classes and the economy remain somewhat unclear. While Harris’s agenda is largely in line with Biden’s policies, she has already indicated a more progressive approach in some areas and more moderate in others. Although we have a better idea of how former President Trump may govern, he still brings uncertainty in the event of another term. Tax policy will be a key fiscal priority due to expiring tax cuts in 2025. Both parties will focus on competition with China and strengthening U.S. industries. Investors should be prepared for regulatory changes that affect sectors like financials/banks. Immigration will also be up for debate as the border crisis reaches a tipping point.

Figure 1

Key policy differences of Trump and Harris[1]

Source: Wilmington Trust as of September 2024

The ability of either candidate to pursue his or her agenda will depend largely on the makeup of Congress. The Republicans currently control the House of Representatives, while the Democrats hold a majority in the Senate. Although a split government is not ideal for policymaking, investors tend to favor gridlock if it means no major legislative changes and, therefore, less uncertainty. In a split government, only those initiatives earning bipartisan support are likely to be implemented.[2]

The Republicans have an opportunity to take control of the Senate as they will be defending fewer seats and are well positioned in states holding elections. The chamber currently consists of 48 Democrats, 49 Republicans, and three Independents that vote with the Democrats (ME, AZ, VT). While recent polling shows that races in Arizona, Maryland, Montana, Nevada, and Ohio are close, the Republicans need to win in just one of these states to earn a majority. The House is harder to predict but is also expected to be close. It currently consists of 221 Republicans, 213 Democrats, and three vacant seats.[3]

Tax policy will be the key fiscal priority

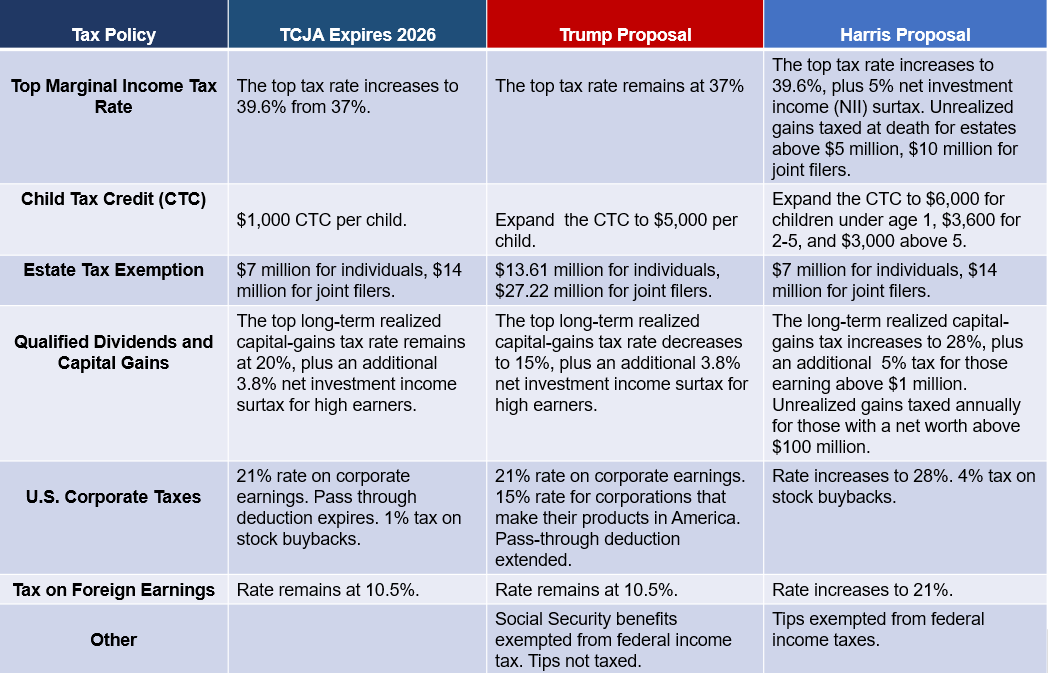

One policy item that must be addressed by the next administration is whether to extend individual tax cuts set to expire January 1, 2026. The Tax Cuts and Jobs Act (TCJA) of 2017 was the signature piece of legislation passed during Trump’s first term. The TCJA reduced the average tax burden across the income spectrum and simplified the tax filing process through structural reforms. Unless Congress acts, 62% of Americans will see higher taxes in 2026.[4] While both candidates are in favor of maintaining the majority of the temporary provisions, they differ on how to achieve this objective (Figure 2).

Figure 2

Tax policy scenarios

Source: Wilmington Trust as of September 2024.

Harris would look to extend all tax cuts for households making less than $400,000, offset with higher taxes on the ultra-wealthy and corporations. Her plan also includes expanding the child tax credit, implementing new incentives for housing, and taxing unrealized capital gains for individuals with incomes and assets exceeding $100 million.[5] Changes to the tax code could incentivize investors to consider tax-advantaged strategies, such as municipal bonds, tax-loss harvesting, and index funds. Along with raising the corporate tax rate to 28%, Harris would double the tax on foreign earnings, which would hit multinational companies like big-tech and pharma the hardest.[6] Utilities and real estate are more insulated from changes to the tax code given rate regulation for utilities and special tax provisions for REITs (real estate investment trusts).[7]

Trump has proposed extending the TCJA in its entirety, as well as introducing additional tax breaks for individuals and corporations.[8] The biggest hurdle in passing Trump’s tax plan is America’s precarious fiscal state. At a time of already high national debt, rising deficits, and elevated interest rates, lawmakers may be more focused on fiscal responsibility when setting tax policy next year. While the probability of a U.S. default is low, a growing deficit could apply upward pressure on rates, increasing federal borrowing costs. The outcome of the congressional races will determine the path of tax policy, likely moderating campaign ambitions. Even with a Democratic trifecta in 2021, Biden failed to get similar legislation passed.[9]

Trade and tariffs

Although the candidates have vastly different economic agendas, they both view trade and tariffs as a tool to maintain U.S. competitiveness. While Harris is widely viewed as a continuation of the status quo, Trump has promised to continue to use executive power in ways that could have a bigger impact on trade and tariffs. The president holds constitutional authority to negotiate with foreign governments on trade, including tariffs. However, the U.S. has traditionally entered new trade agreements using “congressional-executive agreements,” which are negotiated by the president and approved by Congress. This approach could be tested in another Trump term as he looks to implement more aggressive tariffs. He has proposed a 10% to 20% tariff on most imports, and devaluing the U.S. dollar to boost exports. America currently applies an average tariff of 3%, excluding China.[10] Under Harris, we anticipate limited trade frictions with key trade partners and more targeted tariff policy.[11]

We expect both candidates to remain tough on China, albeit to varying degrees. During Trump’s term, the average tariff on Chinese imports was increased from 3.5% to 19%, where they have remained under Biden. In May, new tariffs were announced for steel and aluminum, as well as a 100% tax on electric vehicles (EVs).[12] Harris is expected to continue Biden’s strategy of selective tariffs on Chinese imports and restrictions on outbound investment in emerging technologies, such as AI and quantum computing. Trump has pledged to raise tariffs on all Chinese imports by as much as 60%, and to phase out imports critical to national security, including electronics, steel, and pharmaceuticals. Regardless of who prevails in November, we believe U.S. companies will continue to move supply chains out of China amid rising trade tensions, with India the main beneficiary of this secular trend.[13]

It’s uncertain to what degree Trump’s proposals would be implemented given the potential disruption to the U.S. economy and global trade (Figure 3).[14] While Trump’s previous tariffs had a limited effect on prices—largely because they were absorbed by corporate margins rather than passed onto consumers— that might change if his tariffs are bigger or more broadly implemented. Some U.S. businesses have built up their inventories of critical foreign goods as a hedge against a possible Trump win and higher business costs. Realigning global trade will be a costly and complex endeavor, thus the potential benefits to the U.S. economy could take years to be realized.[15]

Figure 3

Trump's tariff agenda

Source: Wilmington Trust as of September 2024.

Immigration and the workforce

Since 2021, we have seen a sharp increase in the number of immigrants entering the U.S. via the southern border. While the current administration has been reluctant to address the “border crisis,” Biden issued an executive order in 2024 to halt amnesty applications when crossings reach a certain threshold. His 2025 budget also caps the annual number of immigrants allowed to enter the U.S. to 125,000.[16] Harris has signaled she would be open to some reforms, including providing more funding for Customs and Border Protection agents, asylum officers, and immigration judges to help manage the influx of immigrants. However, her stance on the issue is still uncertain.[17]

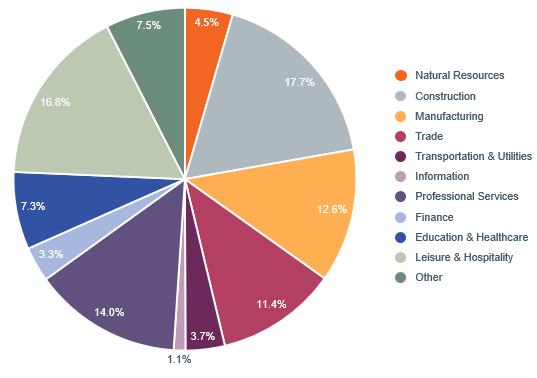

If elected, Trump has promised to impose more restrictive immigration controls. He would likely make a number of these changes via executive orders and bypass the legislative process. From a purely economic point of view, a crackdown on immigrants could have negative implications for industries that rely heavily on unauthorized workers, such as agriculture, construction, and leisure and hospitality (Figure 4). A reduced labor pool could also result in upward pressure on wage growth, creating uncertainty around the path of interest rates. Immigration has been a critical piece of the disinflation puzzle in 2023 and 2024, as greater labor supply has helped to ease wage and price pressures.[18]

Figure 4

Unauthorized immigrants as a percentage of workforce by industry

Source: Moody’s Analytics as of 2024.

Core narrative

The presidential election is shaping up to be a tight race, keeping uncertainty high. As policy paths narrow and we gain more clarity around the election outcome, we will be speaking more to the potential economic implications. At this point, however, it is too soon to make firm conclusions. While changes to taxes, trade, and immigration all have the potential to affect the U.S. economy and markets, they are just a few of many factors we consider when positioning portfolios. Macro dynamics, such as the Fed’s rate-cut cycle, may play a larger role in how asset classes trade broadly and at the sector level over the medium to long term. There is also no guarantee that a candidate’s platform will be adopted by Congress or have the intended impact on the economy. We will continue to monitor election-related risks and opportunities as they evolve and provide regular updates on our current thinking as it relates to Wilmington Trust’s economic and market views. Look for several more Wilmington Wire blog posts that discuss policy agenda items and their potential economic and market implications in greater detail. We are also holding a client webinar on Wednesday, September 25, at 12PM ET, to provide insights on how the election may impact the economy and markets. (Note: the webinar requires preregistration.)

[1] “J.P. Morgan Asset Management (jpmorgan.com),” JP Morgan, July 22, 2024.

[2] Adam Cancryn, “Harris' economic plan supercharges Biden proposals to fight inflation - POLITICO,” Politico, August 16, 2024.

[3] “J.P. Morgan Asset Management (jpmorgan.com),” JP Morgan Market Insights, July 22, 2024.

[4] Garrett Watson, Erica York, “Tax Calculator: How the TCJA Expiration Will Affect You (taxfoundation.org),” Tax Foundation, March,12, 2024.

[5] “Harris Tax Plan vs. Trump Tax Plan | Election 2024 (taxfoundation.org),” Tax Foundation, 2024.

[6] “Harris Tax Plan vs. Trump Tax Plan | Election 2024 (taxfoundation.org).”

[7] “Corporate Taxes Before and After the Trump Tax Law – ITEP,” ITEP, May 2, 2024.

[8] “Harris Tax Plan vs. Trump Tax Plan | Election 2024 (taxfoundation.org)”

[9] Mark Zandi, Brendan Acerda, and Justin Begley, “assessing-the-macroeconomic-consequences-of-harris-vs-trump.pdf (moodys.com),” Moody’s Analytics, August, 2024.

[10] Aimee Picchi, “Trump is proposing a 10% tariff. Economists say that amounts to a $1,700 tax on Americans. - CBS News,” CBS News, June 20, 2024.

[11] Ana Swanson, “With Kamala Harris, U.S. Free Trade Skepticism May Continue - The New York Times (nytimes.com),” NY Times, July 26, 2024.

[12] Kayla Tausche, “Biden to increase tariffs on $18 billion in Chinese imports in a new warning to Beijing | CNN Politics,” CNN, May 14, 2024.

[13] “J.P. Morgan Asset Management (jpmorgan.com)”

[14] Howard Gleckman, “What Trump’s 100% Auto Tariff Proposal Would Mean For The U.S. Economy (forbes.com),” Forbes, March 29, 2024.

[15] Peter S. Goodman, “Businesses Are Already Girding for Next Phase of the U.S.-China Trade War - The New York Times (nytimes.com),” NY Times, August 19, 2024.

[16] Hamed Aleaziz, “Biden’s Executive Order on Immigration: What to Know - The New York Times (nytimes.com),” NY Times, June 4, 2024.

[17] David Knowles, “Harris said she’d sign the bipartisan border bill that Trump stopped. Here's what's in it. (yahoo.com),” Yahoo, August 30, 2024.

[18] “assessing-the-macroeconomic-consequences-of-harris-vs-trump.pdf (moodys.com)”

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today