Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Hybrid financing facilities have long been a familiar solution for borrower entities needing capital. The proliferation of debt and equity capital products and the rise of private non-bank lenders create seemingly endless combinations for borrowers, from those with the highest credit quality to those with high risk.

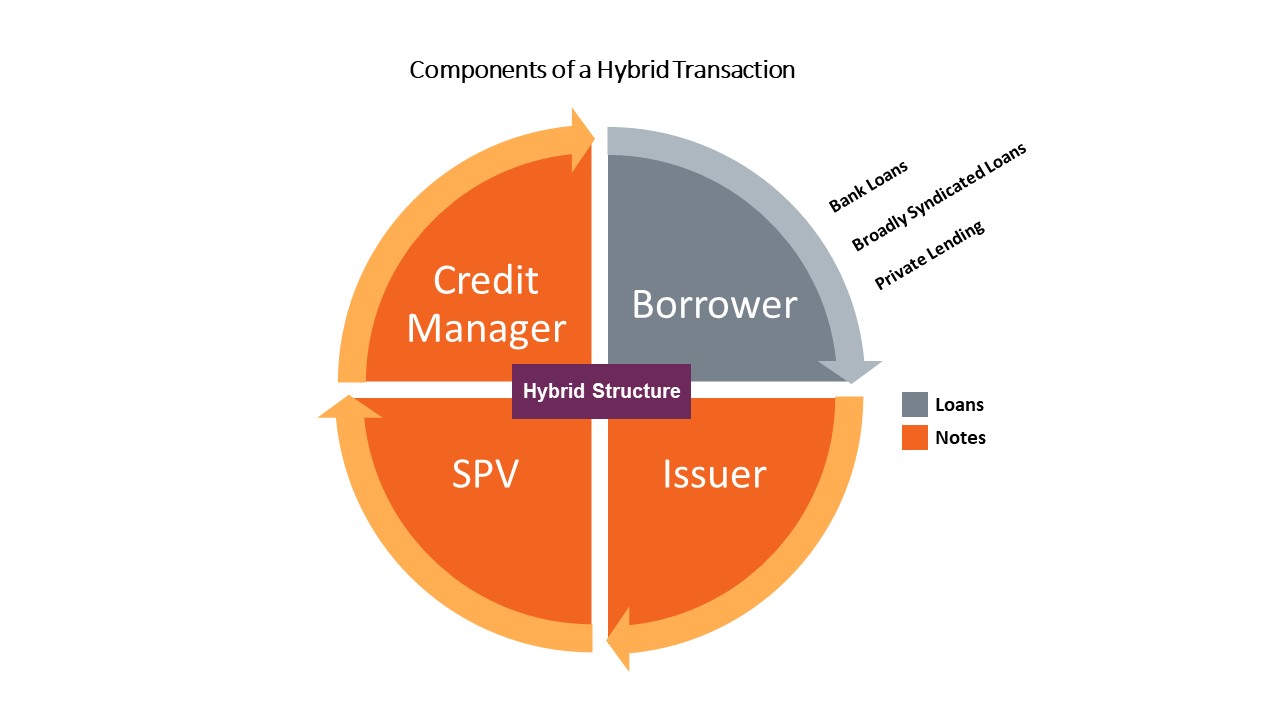

| The term “hybrid financing” is used in many contexts. This article uses “hybrid” to refer to any transaction that includes multiple asset class structures in a single holistic transaction. Combinations can consist of various types of loan (bank, syndicate, and private lender) and/or debt (loan-and note-based, including bonds and structured products). |

But in the current economy, several factors and stakeholders contribute to the interest in hybrid deals. First, many banks have drastically tightened lending, leading to a search for innovative solutions to financing. Second, private lenders such as private equity and venture capital firms have accumulated more dry powder, increasing the pressure to find investible assets. Third, credit managers are bundling various loans into structured facilities, funding them to purchase forward flow loan activity, and then aggregating the loans. Here, both the facility and the loans need servicing. Finally, insurance companies are participating in debt capital markets to access credit assets via these structured products.

In our roles as agent and trustee across a wide range of transactions, we are finding strong demand for hybrid solutions. Our clients have been especially attuned to the benefits of having a consolidated footprint under a single provider who can simultaneously service many elements in a hybrid deal. This approach offers cohesive servicing and lower cost in scenarios that otherwise could be quite complex.

The lending side of a hybrid financing facility brings together traditional bank lending and alternative financing from private or non-bank lenders. This combination offers borrowers a more extensive and diversified funding pool. It also allows lenders to share risk and potential returns, promoting a more resilient and dynamic structure. While banks have typically offered low interest rates, rising rates and tighter lending conditions have made traditional financing approaches less appealing and accessible for borrowers. On the other hand, private lenders often display a greater readiness to accept higher risk.

Combining loans and notes creates the option to raise capital as both a borrower and issuer. Some participants in such a debt structure have constraints that allow them only to participate in a loan or a bond. On the borrower side, loan proceeds can fund a Special Purpose Vehicle (SPV) that issues notes. These transactions offer the benefits of both types of instruments. The loan component provides a flexible funding source with negotiable interest rates and payment terms. In contrast, the notes offer a straightforward, less restrictive source of capital with few or no collateral requirements and lower levels of oversight than with lenders.

Structured facilities also combine the features of loans and notes. For example, a credit manager might issue notes and arrange loans to fund a portfolio of consumer loans, such as auto or home improvement loans. As a result, investors can access a broader range of assets than traditional loans or notes, including consumer-based asset classes that may not be available through other means. This hybrid scenario provides more flexibility with the types of loans and notes that can be included in a portfolio, as well as the amounts and maturities of these instruments

From a capital raising perspective, hybrid financing offers several compelling advantages. It expands access to capital and creates flexibility in structuring the financing to meet their specific needs and circumstances. This flexibility can take various forms, such as adjusting the proportion of loans to bonds, bank to non-bank financing, negotiating repayment terms, setting multiple tenors, or tailoring documentation.

Lenders and noteholders also stand to benefit significantly from hybrid financing. For lenders, hybrid financing allows banks to maintain relationships with clients while sharing the risks of larger or riskier loans with other lenders. Private or non-bank lenders, on the other hand, have an opportunity to participate in larger, often more lucrative, loan transactions that might otherwise be beyond their reach. Finally, noteholders can broaden the options available for their fixed-income strategies. Across the board, this diversification can contribute to managing risk across the portfolio and potentially achieving more stable returns.

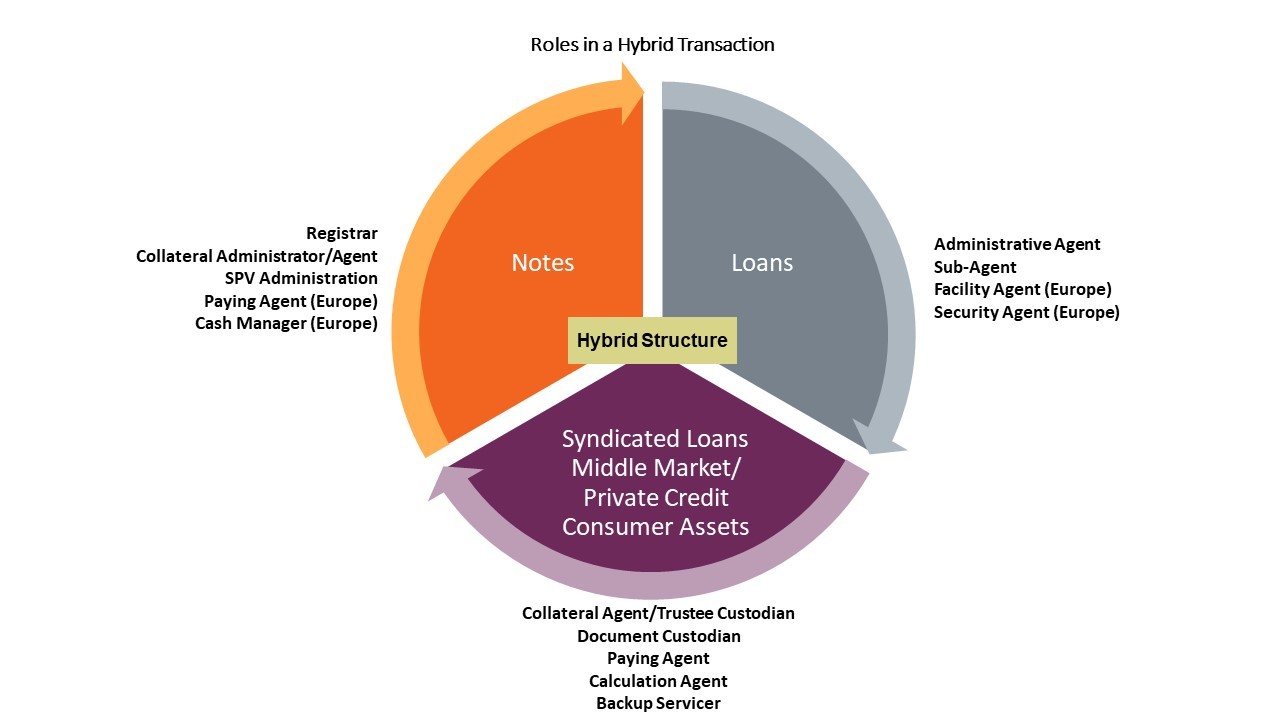

Navigating the complexities of hybrid financing requires expertise and dedication from third-party providers, including agents and trustees. These providers ensure timely and consistent communication among all parties, handle administrative tasks, and monitor compliance with the agreed-upon terms.

In hybrid financing transactions, consolidating various roles under a single third-party provider has several advantages. In this one-stop-shop approach:

Third-party providers are particularly crucial in managing the relationship dynamics in a hybrid financing setup. Their involvement helps maintain a balanced interaction between bank and non-bank lenders. In addition, they ensure that all parties’ interests are represented and manage any potential conflicts that may arise during the lifespan of the loan.

Hybrid structures are well-suited to the unique capital market conditions of recent and future quarters. The potential they create for operational efficiencies, reduced costs, and access to a broader range of strategies seems especially attractive.

Moreover, we expect continued innovation in packaging and unifying multiple financing structures into a single deal with a single set of deal documents. As a result, the role of third-party providers is crucial. They can play a significant part in holding the diverse elements of hybrid financing together, providing efficient transaction management, and facilitating beneficial relationships between all parties.

For the experience you need to support transactions in the bank loan and securitization markets, contact a Wilmington Trust Loan Market Specialist today.

Wilmington Trust’s domestic and international affiliates provide trust and agency services associated with restructurings and supporting companies through distressed situations.

Not all services are available through every domestic and international affiliate or in all jurisdictions.

This article is intended to provide general information only and is not intended to provide specific investment, legal, tax, or accounting advice for any individual. Before acting on any information included in this article you should consult with your professional adviser or attorney. Facts and views presented in this report have not been reviewed by, and may not reflect information known to, or the opinions of professionals in other business areas of Wilmington Trust or M&T Bank. M&T Bank and Wilmington Trust have established information barriers between their various business groups.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today