Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

September 20, 2021—German stocks have had a strong run of performance in 2021 through September 17, returning 12.3% in EUR terms and 7.7% in USD terms. More broadly, Euro Area stocks have returned 17.8% in EUR terms and 13.0% in USD terms. Consequently, our portfolio construction overweights to international developed country stocks have made a significant contribution to portfolio performance.

Strong German equities performance is due mainly to improving economic conditions across German firm’s worldwide markets. But it has also been due to the constructive fiscal policy environment provided by the current German political coalition. The coalition is led by Angela Merkel’s center-right Christian Democrats (CDU/CSU), with Olaf Scholz’s center-left Social Democrats (SPD) as junior partner. In particular, the coalition was able to tackle the pandemic-generated recession through a waiver of debt brakes and a large domestic fiscal stimulus program.

However, the next German general elections are on September 26, and this will be the first election in 16 years in which the powerful and popular Merkel has not run for chancellor. This Wilmington Wire explores the possible outcomes of the election and their investment implications.

What are the polls saying?

It seems likely that Olaf Scholz of the SPD will become the next chancellor, beating out Merkel’s hand-picked CDU Party chair, Armin Laschet, currently the prime minister of the state of North Rhine Westphalia.

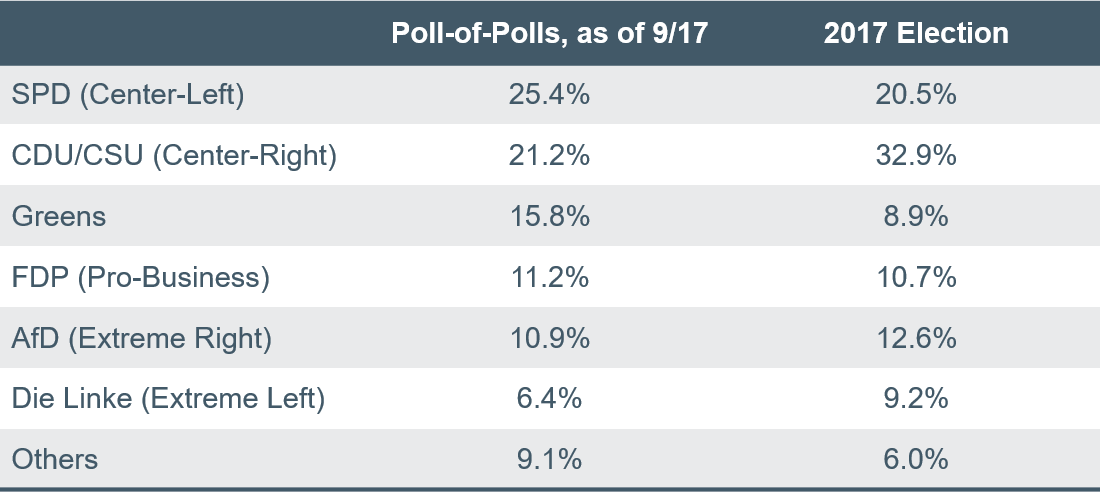

The September 17 Bloomberg poll-of-polls (see Figure 1) projects that SPD will win 25.4% of the vote, versus 21.2% for the CDU/CSU. Because parties garnering less than 5% of the vote are excluded from the parliament, the remaining parties would be assigned a greater percentage of parliamentary seats than implied by the polling numbers. Still, Olaf Scholz would need to form a multiparty coalition to become chancellor.

Figure 1: Bloomberg poll-of-polls

Source: Bloomberg. Data as of September 17, 2021.

Why is Olaf Scholz likely to be the next chancellor?

Olaf Scholz has been serving as vice chancellor and finance minister in the current Merkel coalition government. He has won public recognition as a pragmatic and competent crisis-manager throughout the pandemic. In his role, he secured a public waiver of debt limitations and implemented a surge of fiscal stimulus to address the pandemic’s economic costs. He was a key participant in fashioning the EU’s own expansive multiyear fiscal program. He also managed to secure a key SPD budget demand, creating a basic pension for low income employees.

By contrast, the public tends to view Sholz’s opponent, Armin Laschet, as less of an administrator and more of an out-of-touch politician. He lost considerable public support during the disastrous floods that wracked his home state, especially after he was caught laughing on video. In fact, a poll by the Forsa Institute indicates that if Germans could directly elect their chancellor, only 11% would vote for Laschet, versus 30% for Scholz, and 15% for Annalena Baerbock, the Green candidate.

Scholz’s policy program is also more popular with Germany’s lower and middle classes than Laschet’s fiscally hawkish agenda. While Scholz does envision a return to lower fiscal spending after the pandemic ends, he is also open to income tax cuts for middle income workers, in part paid for by a wealth tax. He also seeks a significant increase in the minimum wage.

What are the possible coalitions?

The exact program of any government led by Sholz will depend on the deal he negotiates with coalition partners. It could take several months to form a coalition, as many policy details and ministerial assignments would have to be negotiated. With one low-probability exception, the possible coalition permutations are all constructive for German stocks.

It would be relatively easy for the SPD to negotiate with the CDU/CSU. Of course, Scholz has already had experience working with the CDU/CSU. The CDU/CSU would insist that SPD moderate its fiscal and minimum wage demands, without abandoning them altogether. Another advantage to including the CDU/CSU is that the party brings with it the administrative experience of governing Germany during Merkel’s 16 years in office.

Current polling suggests that a coalition between SPD and CDU/CSU may fail to exceed 50% of seats. Therefore, Scholz would likely need to include a third party, either the Greens or the FDP. It would be relatively easy for Scholz to negotiate a coalition involving the CDU/CSU and Greens. Carbon reduction is a high priority for all three parties.

Negotiating a coalition including the FDP (either with CDU/CSU or with the Greens) may be more difficult for the SPD. The Free Democratic Party is the pro-business “chamber of commerce” party. It is opposed to SPD proposals for a higher minimum wage and wealth tax. It wants a reduction in corporate tax rates. It is less “green” than the SPD and CDU. Finally, it is less enthusiastic than these other parties about further EU integration, fearing likely greater business regulation. Any coalition involving the FDP would likely further constrain the SPD’s ability to implement its fiscal and minimum wage demands.

There is one theoretically possible, though we believe highly unrealistic, coalition permutation that may keep some investors awake at night. It is possible that Die Linke, the hard-left successor to the East German Communist Party, may squeak by the 5% threshold for entry to parliament. Scholz has already personally ruled out any coalition involving Die Linke, mainly because of its opposition to NATO. However, left-wingers in the SPD may insist on discussions with Die Linke in the event other negotiations with the CDU/CSU, Greens, and FDP fail.

Should the SPD find itself negotiating with Die Linke, it seems likely that the Armin Laschet of the CDU/CSU would do anything it takes to bring the FDP and Greens into an alternative coalition. The German constitution does not exclude the possibility of the chancellor representing the second largest bloc of seats in the parliament, but it would be the first time this has occurred in the Republic’s history.

Core Narrative

Angela Merkel has provided a great deal of stability for Germany and the EU during her 16 years of office. However, the pandemic demanded a pragmatic and competent response, and Olaf Scholz rose to that requirement. He offers a policy program that, while somewhat more fiscally expansionary than what the CDU/CSU might offer of its own accord, remains middle-of-the-road and rational. Any one of the probable coalitions led by Scholz would ensure that Germany will continue to provide a constructive policy environment for the German economy and stocks domiciled there. Any one of these probable coalitions would also be constructive for the broader European economy, especially given that elections in other European countries are still some ways off. All-in-all, we expect the German election outcome to reinforce our Investment Committee overweight to international developed stocks, which are weighted toward European stocks.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today