Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

It is easy for investors to become engrossed—even overwhelmed—by the amount of uncertainty in the world today. Recession worries lurk in the background, ready to pounce on any disappointing piece of economic data. The 2024 U.S. presidential election season has already delivered more surprises than any in recent history and is still four weeks away. Geopolitical risk is at a boiling point in many parts of the world.

Yet focusing on these uncertainties runs the chance of overlooking the many areas in which we have gained more clarity—insight that gives us the conviction to remain overweight to equities versus our strategic benchmark. First and perhaps most importantly, inflation is showing little sign of rearing its ugly head again, and the Federal Reserve has officially embarked on a rate-cut cycle that is very likely to last through 2025. Positive economic data far outweigh some yellow warning signals, increasing the odds of a “soft landing.” The long-awaited broadening of equity leadership is finally occurring and is likely in early innings. We are even getting some positive developments out of China, where years of disappointing economic data have finally elicited a bold, stimulative response from policymakers.

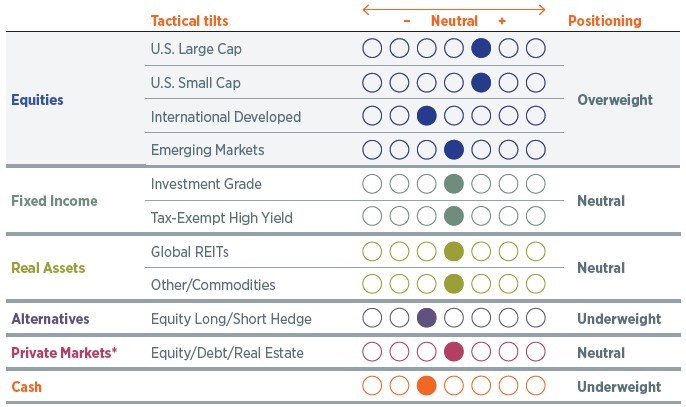

Despite some “known unknowns”—most prominently the policy implications of next month’s elections—there are many more data points that we do know, which are collectively pointing us toward an overweight allocation to equities, underweight position to cash and hedge funds, and neutral allocation to fixed income. And as regards the election, we are cautiously optimistic that most outcomes, namely anything other than an unlikely blue sweep wherein the Democrats win control of the presidency and both houses of Congress, will provide further tailwinds to U.S. stocks.

Figure 1: No sign of significant job loss

Continuing unemployment claims rate by month (%)

Data as of 9/15/2024. Sources: Department of Labor, Wilmington Trust. Note: Data are not seasonally adjusted (NSA). The unemployment claims rate is the percentage of people collecting unemployment insurance benefits as a share of those eligible for the program.

The U.S. economy continues to surpass expectations. The most recent four quarters are tracking at a 3% growth rate as consumer activity remains strong. The labor market has loosened but is healthy, with job growth averaging 186,000 net new jobs over the past three months. The unemployment rate ticked up in July on the back of an expanding labor pool but has since receded to 4.1%, and unemployment claims are very low, both on an absolute basis and as a share of the population (Figure 1). The services economy remains strong, evidenced by purchasing manager surveys, spending data, and corporate earnings reports. We expect economic activity to slow into the tail end of this year, bringing 2024 GDP growth to 2.5%—a full percent higher than we forecasted at the start of the year. Despite some slowing in consumer activity ahead, we place a relatively high 70% probability that the economy will continue to expand over the next 12 months or, in other words, that we will not experience a recession over that time.

Inflation has been tamed, ushering in the first of many rate cuts from the Fed. The central bank is projecting another 150 basis points or bps (1.50%) of rate cuts through the end of 2025. We expect more easing from the Fed on the order of 200 bps of total rate cuts over the next 15 months, which would bring down the fed funds rate to the Fed’s projection of the long-run “neutral rate” (the rate that neither stimulates nor slows the economy). This should ease borrowing costs for consumers and businesses alike. The September rate cut of 50 bps is already breathing life into parts of the real estate market. We should also see easier monetary policy lift profit margins for small businesses that we expect to, over time, provide relief to credit card and auto borrowers.

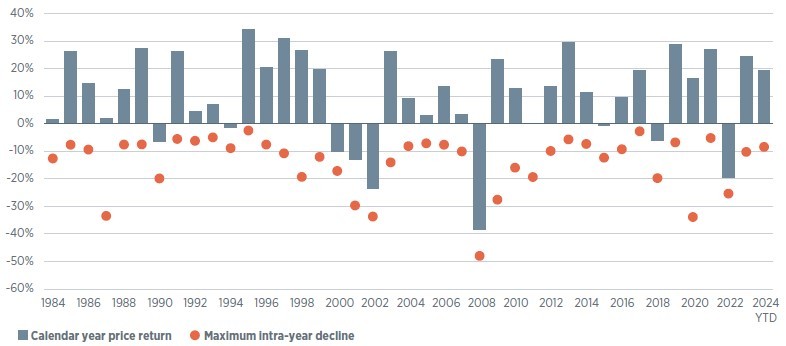

Figure 2: Equity market drawdowns are a part of investing

S&P 500 calendar-year % returns vs. intra-year% declines

Data as of 10/3/2024. Bars represent S&P 500 price return data. Sources: Bloomberg, WTIA.

Past performance cannot guarantee future results. Indices are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

This level of optimism is not to suggest we aren’t looking around every corner for signs the economy could be weaker than we think. We are. Rising credit delinquencies (especially for younger and lower-credit borrowers) and falling job openings bear watching. Collectively, the data continue to point to an economy normalizing in the post-pandemic era. Last, we do not see any obvious catalysts that could throw the economy into a recession.

Our constructive economic baseline translates into a positive outlook for the equity market over the next 9–12 months. Make no mistake, expectations must be managed. The S&P 500 has returned more than 20% year to date (1/1/2024 – 9/30/2024) and 34% over the last 12 months (9/30/2023 – 9/30/2024). These returns are unlikely to be repeated over the next year. Bloomberg consensus expects earnings to grow by 15% next year, and the index is trading at a price-to-earnings (P/E) ratio of 21.7 times those forward earnings growth estimates. Simply put, a lot of good news is priced in, and the market may need to “tread water” for a bit as we await a new positive catalyst.

We expect mid-single digit returns with considerable volatility from equities over the next 12 months as the economy chugs along and the Fed cuts rates. During that time, we believe one or more short-term market corrections are likely. That, however, would be par for the course and not cause for alarm (Figure 2). Outside of a recession or significant growth scare, such a pullback would likely be short, shallow (probably around 10–15%), and representative of an attractive opportunity for deployment of excess cash.

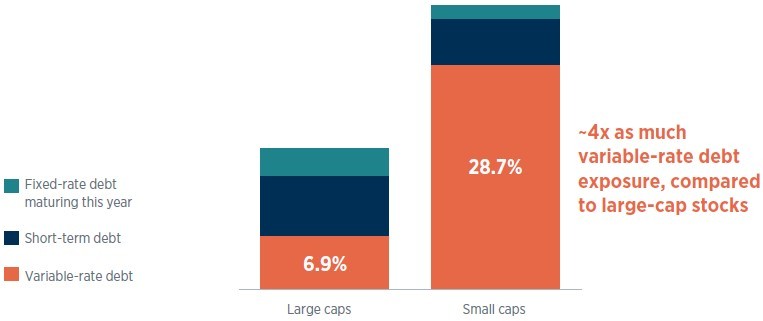

Figure 3: Small caps a benefiricary of rotation trade, rate cuts

Large cap and small cap (ex-financials and real estate) share of debt that is rate sensitive

Data as of 7/31/2024. Source: Empirical Research Partners, Factset Research. “Large caps" represents the 750 largest U.S. stocks. “Small caps” represents the next 2000 largest.

As the market rally continues, we find it very encouraging that leadership has broadened since the summer. A key theme for our positioning this year was an expectation of better participation from non-tech sectors and smaller companies, but it took longer to play out than we anticipated. Over the last three months, U.S. small cap has been the best-performing asset class, outpacing U.S. large cap by more than 4%. Returns from real estate, utilities, and financials have handily beaten those of the technology sector. Such an improvement in market breadth has benefited many of our active managers.

We are positioned with an overweight to equities, an underweight to cash, and a neutral allocation to fixed income. Despite the Fed cutting rates, we think any decline in rates will be limited to the short end of the curve, and the 10-year Treasury yield could actually move a bit higher over the next 9–12 months. This steeper yield curve could limit the return potential of medium-to-long-duration fixed income. Our equity overweight favors U.S. large cap and U.S. small cap, and we hold an underweight to international developed equities. U.S. small cap stands to benefit from rate cuts, as smaller companies hold four times the amount of variable-rate debt than larger companies (Figure 3). While small-cap valuations are not cheap by their own history, they do look attractively priced relative to U.S. large cap. International developed equities have done reasonably well this year despite a weak economy. With European manufacturing still in the doldrums and services activity rolling over, we think an underweight to international developed equities is appropriate.

Layered on top of our baseline economic and market outlook are various potential U.S. election outcomes. The election is less than a month away, and a lot can change in that time. Uncertainty is prevalent on three levels: 1) the election outcome, 2) the policies that will be enacted by the elected official versus what is touted on the campaign trail, and 3) the economic and market impacts of those policies.

We discussed the economic and market implications of the election in detail in a recent webinar. In the interest of brevity, I will make just a few important points here. First, at this time, with the Republicans likely to flip the Senate, we are cautiously optimistic on the market reaction to the election in most scenarios. If Harris wins, we would have divided power, bringing, more or less, an extension of the status quo. This would not be a bad outcome for markets, particularly since we would anticipate the Republican-controlled Senate to prevent the Harris administration from further expanding the deficit and potentially help shrink that number.

A Trump outcome poses greater uncertainty, since it is impossible to know how aggressively a second Trump administration would actually pursue the stated tariff and immigration positions of now candidate Trump. And if enacted in large measure, it is not entirely clear what economic impact these policies would have. Nonetheless, as a baseline, we would expect a second Trump administration to usher in a favorable tax and regulatory climate for American businesses. This coupled with a judicious approach on tariffs should support stocks. At the same time, we very much recognize that, fully implemented, Trump tariffs would likely result in short-term inflation, trade wars, and a recession. Therefore, in the case of a Trump outcome, the markets will be looking to a president-elect Trump for reassurance that he will move cautiously in this area. We would expect heightened volatility in this scenario.

Also, given the lack of focus on fiscal discipline from either candidate, higher deficits, inflation, and interest rates are a distinct possibility under any scenario. This makes fixed income relatively less attractive. The best case for our fiscal state is likely a divided government, but here we would expect to see tense, volatility-inducing debates around the funding of government and the debt ceiling, the latter of which could move front and center by mid-2025.

Luckily, we are heading into the election on sound footing. Be on the lookout for more updates to come ahead of and once a winner has been declared post Election Day.

Figure 4: Current positioning

High-net-worth portfolios with private markets*

* Private markets are only available to investors that meet Securities and Exchange Commission standards and are qualified and accredited. We recommend a strategic allocation to private markets but do not tactically adjust this asset class.

Data as of 9/30/2024.

Positioning reflects our monthly tactical asset allocation (TAA) versus the long-term strategic asset allocation (SAA) benchmark. For an overview of our asset allocation strategies, please see the disclosures.

As we move through the final quarter of the year, we think it’s important to keep in mind what we do know, as tempting as it is to focus only on what we do not know. Uncertainty and investing go hand in hand. The key is to avoid drastic damage to portfolios by making significant moves ahead of high-profile events like elections. At this time, we retain an overweight to equities in portfolios and are carefully monitoring risks to determine what, if any, adjustments are warranted.

Please see important disclosures at the end of the article.

Please complete the form below and one of our advisors will reach out to you.

* Indicates a required field.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today