Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

March 1, 2021—Some of our advisors and clients have asked whether the Investment Committee (IC) might make a tactical allocation to emerging markets U.S. dollar (EM USD) bonds. No doubt these questions are motivated by the fact that EM USD bonds offer higher yields than U.S. investment-grade bonds and involve return streams that are only partly correlated to those of other asset classes.

Our strategic asset allocation (SAA) scheme doesn’t specify a distinct fixed income asset class for EM USD bonds. However, this doesn’t preclude IC from tactically allocating to such bonds when they offer a compelling investment opportunity. In any such consideration, we would be mindful of the increase to our portfolios’ overall tracking error with respect to the SAA benchmark.

This Wilmington Wire describes the EM USD bond market and describes two future scenarios in which it might make sense to make an allocation.

What is the EMUSD bond market?

The EM USD bond market was born of the wreckage of the EM syndicated loan market following the Latin America, Russia, and Asia sovereign debt crises of the 1980s–1990s. These crises were characterized by contagion—one sovereign after another defaulting. Banks exchanged their distressed Mexican sovereign loans, at a discount, for Brady Bonds, named for President Reagan’s Treasury Secretary Nicholas Brady. Soon, such distressed-debt exchanges spread to other markets. A secondary market for such bonds emerged. Eventually, EM governments began placing sovereign bonds in the primary market.

The EM USD bond market has gradually grown since the turn of the century, reaching USD 2.3 trillion, or about one-tenth the size of the U.S. investment-grade aggregate bond market. The market covers sovereign bonds or issuers in many countries, including, Indonesia, Russia, Qatar, United Arab Emirates (UAE), Turkey, the Philippines, Columbia, Ecuador, Argentina, Ukraine, Panama, and Kazakhstan. The market has also broadened from sovereigns to include government agencies, state-owned enterprises (SOEs), and non-government companies. Many of the SOEs and other companies are in China.

It is important to recognize that EM USD bonds do not participate in upside global (or EM) economic growth to the same degree that EM equities do. Rapid economic growth drives the corporate earnings of EM stocks, and in turn their share prices. Rapid growth may help narrow EM credit spreads, but there is a limit to spread narrowing. Furthermore, rapid growth may also push Treasury yields higher, which would reduce returns for EM USD bonds, given their long durations.

EM USD sovereign bonds also involve exposure to political risks. To service an external dollar bond, an EM government must be able and willing to assign enough fiscal resources and foreign exchange to cover contractual dollar debt. This requires political choices about which constituencies to favor. In a financial crisis, it may be necessary to prioritize foreign bondholders differently for political reasons. Some governments rely on oil exports for fiscal revenues, have authoritarian governments, suffer corruption, or face other political instability.

Despite elevated levels of political risk involving some issuers, market memory of the EM sovereign debt crises (and contagion effects) of the late 20th century has faded. Over the last two decades, EM sovereign bond defaults have been sporadic and idiosyncratic, with only Argentina and Venezuela generating significant press coverage. As a result, investors and rating agencies have been treating EM USD debt as low investment grade (one or two notches above speculative grade). Investors have been willing to accept longer maturities and lower coupons than those offered in the U.S. high-yield market. Over the last year, investors have generally remained unconcerned about the possibility that the pandemic may trigger an EM financial crises.

When will the time be right to invest in EM USD bonds?

The EM USD bond asset class is likely to be most attractive in the aftermath of several EM sovereign defaults, when even bonds unlikely to default might be available at highly discounted prices. If the pandemic triggers EM sovereign defaults, that could be the moment to act. Specialist EM bond managers would be able to discriminate between bonds that are more likely to default and those that are less likely. Of course, there are also hedge funds who invest in distressed EM bonds, such as those who have pursued Argentina for many years through courts.

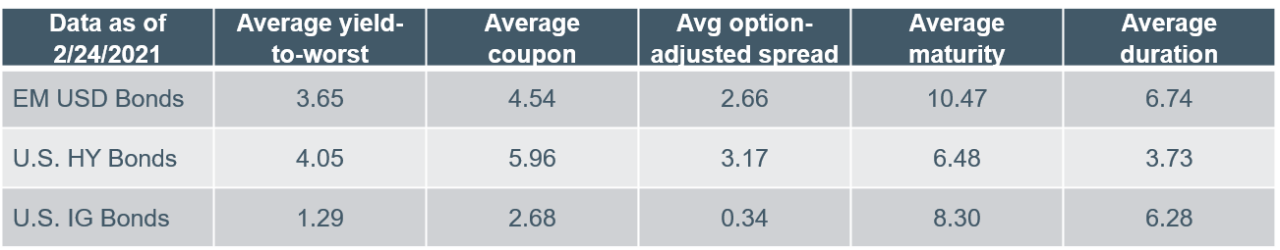

A second scenario meriting serious consideration of EM USD bonds would be the stability of USD 10-year Treasury yields, given the long duration of the asset class, and provided that yields exceed those for U.S. high-yield corporates, and that both sets of yields remain higher than their respective long-term means and thereby mean revert. These conditions do not apply in the current environment of rising Treasury yields and narrow credit spreads. However, they could apply in the future.

Core narrative

At the current time, we do not find a compelling justification for adopting an off-SAA allocation to EM USD bonds. However, there are scenarios, such as the ones noted above, which would merit serious IC consideration. As always, we will be closely monitoring market conditions that might give rise to such consideration.

Data as of February 24, 2021. Sources: Bloomberg/Barclays.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Investments: Are NOT FDIC Insured | Have NO Bank Guarantee | May Lose Value

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners. Indexes are not available for direct investment.

An overview of our asset allocation strategies: Wilmington Trust offers seven asset allocation models for taxable (high-net-worth) and tax-exempt (institutional) investors across five strategies reflecting a range of investment objectives and risk tolerances: Aggressive, Growth, Growth & Income, Income & Growth, and Conservative. The seven models are High-Net-Worth (HNW), HNW with Liquid Alternatives, HNW with Private Markets, HNW Tax Advantaged, Institutional, Institutional with Hedge LP, and Institutional with Private Markets. As the names imply, the strategies vary with the type and degree of exposure to hedge strategies and private market exposure, as well as with the focus on taxable or tax-exempt income. Model Strategies may include exposure to the following asset classes: U.S. large-capitalization stocks, U.S. small-cap stocks, developed international stocks, emerging market stocks, U.S. and international real asset securities (including inflation-linked bonds and commodity-related and real estate-related securities), U.S. and international investment-grade bonds (corporate for Institutional or Tax Advantaged, municipal for other HNW), U.S. and international speculative grade (high-yield) corporate bonds and floating-rate notes, emerging markets debt, and cash equivalents. Model Strategies employing nontraditional hedge and private market investments will, naturally, carry those exposures as well. Each asset class carries a distinct set of risks, which should be reviewed and understood prior to investing. Allocations: Each strategy is constructed with target weights for each asset class. Wilmington Trust periodically adjusts the target allocations and may shift away from the target allocations within certain ranges. Such tactical adjustments to allocations typically are considered on a monthly basis in response to market conditions. The asset classes and their current proxies are: large–cap U.S. stocks: Russell 1000® Index; small–cap U.S. stocks: Russell 2000® Index; developed international stocks: MSCI EAFE® (Net) Index; emerging market stocks: MSCI Emerging Markets Index; U.S. inflation-linked bonds: Bloomberg/Barclays US Government ILB Index; international inflation-linked bonds: Bloomberg/ Barclays World exUS ILB (Hedged) Index; commodity-related securities: Bloomberg Commodity Index; U.S. REITs: S&P US REIT Index; international REITs: Dow Jones Global exUS Select RESI Index; private markets: S&P Listed Private Equity Index; hedge funds: HFRI Fund of Funds Composite Index; U.S. taxable, investment-grade bonds: Bloomberg/Barclays U.S. Aggregate Index; U.S. high-yield corporate bonds: Bloomberg/Barclays U.S. Corporate High Yield Index; U.S. municipal, investment-grade bonds: S&P Municipal Bond Index; U.S. municipal high-yield bonds: Bloomberg/Barclays 60% High Yield Municipal Bond Index / 40% Municipal Bond Index; international taxable, investment-grade bonds: Bloomberg/Barclays Global Aggregate exUS; emerging bond markets: Bloomberg/Barclays EM USD Aggregate; and cash equivalents: 30-day U.S. Treasury bill rate.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today