Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Since the end of WWII, the U.S. dollar has held the coveted status of global reserve currency.[1] A reserve currency is one that is held by global central banks or treasuries in large quantities and utilized for international trade, financial transactions, and currency management. There is growing speculation that the U.S. dollar’s prominence may fade, being replaced by other fiat or digital currencies. This is being driven by several geopolitical developments. Aggressive financial sanctions against Iran, Russia, and others have motivated some countries to reduce reliance on the dollar and find alternatives for the dominant financial messaging system known as SWIFT[2] (Society for Worldwide Interbank Financial Telecommunication). China has promoted its currency, the renminbi, instead of the U.S. dollar in settling trade with countries in Asia and Latin America, a move that appears to be gaining some steam based on recent support from Brazil’s president.[3] On-again-off-again talks between Saudi Arabia and Beijing to price oil in renminbi have accelerated—something that would be historic given the longstanding role of the dollar in settling global oil sales.[4] In our view, the reserve currency landscape, like the geopolitical landscape, could become more fractured in the decades to come, but we do not see a replacement—not even in the renminbi—for the unique set of attributes possessed by the U.S. dollar that make it the standard for trade, financial transactions, and central bank reserves.

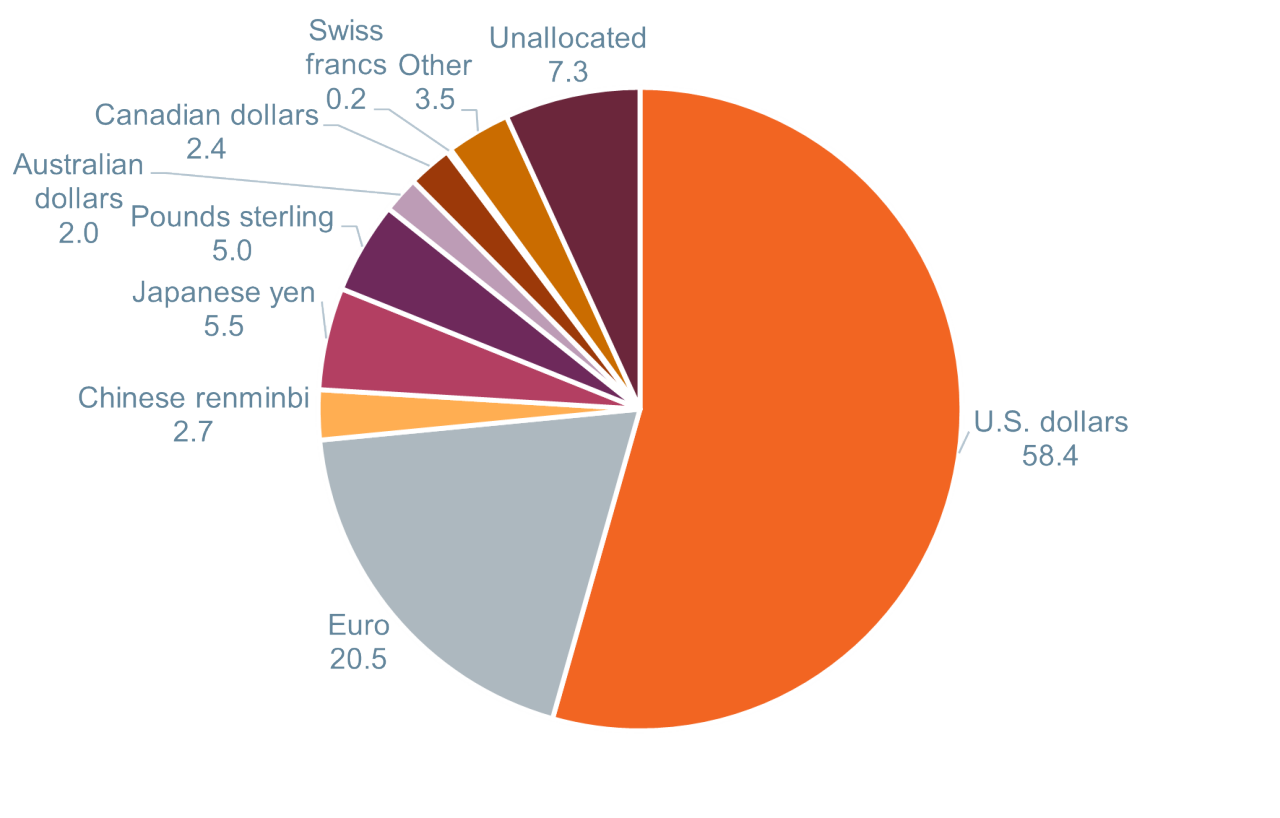

The U.S. dollar has comprised a majority of global currency reserves for the last 60 years, replacing the pound sterling for the better part of the post-war era.[5] The U.S. dollar’s share of currency reserves peaked around the dissolution of the Bretton Woods system, losing share over that period mostly to the euro, yen, and Canadian and Australian dollars. Since 2000, the dollar has declined from approximately 70% of reserves to 58%,[1] as of the fourth quarter of 2022 (Figure 1), with approximately one quarter of that lost share being taken by the Chinese renminbi. Today, the renminbi is a still modest 2.7% of total reserves[2] (of which Russia holds nearly one third[3]).

Figure 1: Dollar dominates as reserve currency

Composition of global currency reserves (%)

As of December 31, 2022.

Source: International Monetary Fund.

The dollar’s dominance as global reserve currency is due to multiple factors, which in totality have yet to be replicated:

Recent headlines, China’s growing role in the global economy, and increased tensions with the U.S. have led some to suggest that if the U.S. dollar were to cede its place as dominant reserve currency, it could be to the Chinese renminbi. While a more fractured currency landscape is possible—and certainly one of China’s goals—it is very unlikely that the renminbi would replace the U.S. dollar in the next decade. Even if China were to surpass the U.S. economy in size and manage to settle its roughly $6.5 trillion worth of annual trade[6] in renminbi, the U.S. dollar is currently involved in nearly 90% of global foreign currency transactions, amounting to $6.6 trillion per day.[7]

Perhaps more detrimental to the renminbi’s reserve currency prospects are their capital controls and unpredictable laws. China operates under a “closed” capital account policy, whereby companies, banks, and individuals cannot freely move money into or out of the country.[8] For a central bank to feel comfortable holding significant reserves in a particular currency, it must know it can act without restrictions.

In addition, the unpredictability of China’s policies, as well as the U.S.-China relationship, is a significant detriment to the renminbi. China’s regulatory crackdown in 2021—resulting in the nationalization of the for-profit education industry, strict regulations on platform tech companies, and restrictions on the amount of time consumers can spend gaming[9]—dealt a significant blow to investor confidence. Investors pulled a record amount of assets from the Chinese stock market in 2021.[10] Since then, President Xi Jinping has only further consolidated his power. Threats of securities delistings, trade blacklists, and geopolitical threats between the U.S. and China add to the hesitancy on the part of investors to reallocate to China in sufficient size as to increase the renminbi’s prominence.

Digital currencies are another potential way for central banks to diversify away from dollar reserves. However, when it comes to reserves, we see it more likely that central banks would develop and utilize central bank digital currencies (CBDCs) rather than hold reserves in cryptocurrencies like bitcoin. A digital dollar may cannibalize its fiat counterpart but would not alter the economic risks and benefits associated with the dollar’s status as dominant reserve currency.

Core narrative

The U.S. economy has enjoyed reserve currency status for decades, and with it several privileges including considerable latitude in issuing debt. We don’t expect this status to disappear any time soon. However, a fracturing of the currency landscape is possible over the next few decades. Should that occur, we would expect the U.S. dollar to structurally weaken and the cost of borrowing to increase for the U.S. government.

In the shorter term (next 9–12 months) the direction of the dollar will be dominated by the Fed’s monetary policy relative to other major central banks. Economic momentum improved outside of the U.S. to start the year, resulting in dollar weakness. The market is pricing two rate cuts of 25 basis points,* or bps (0.25%) each in the second half of 2023 as inflation slows and recession risks rise. However, we remain skeptical that the Fed will be in a position to ease policy so soon, so some of the dollar’s depreciation this year could reverse, particularly if economic momentum in Europe or China cools. We focus on international diversification in our portfolios, though we do not explicitly hedge currency risk at the portfolio level (individual managers may do so). At this time, we are positioned defensively in anticipation of a mild recession this year. We hold an underweight to equities, both in U.S. small-cap and international developed asset classes, and an overweight to cash and fixed income.

Disclosures

[1] https://www.cfr.org/backgrounder/dollar-worlds-currency

[4] Wall Street Journal, https://www.wsj.com/articles/saudi-arabia-considers-accepting-yuan-instead-of-dollars-for-chinese-oil-sales-11647351541

[5] IMF, Barry Eichengreen (2014), “International Currencies Past, Present and Future: Two Views from Economic History, Visual Capitalist https://www.visualcapitalist.com/cp/how-reserve-currencies-evolved-over-120-years/

[6] IMF

[7] IMF

[9] As of April 2023, IMF.

[10] Bank for International Settlements

[11] Bank for International Settlements

[12] As of 2020. Source: Bank for International Settlements; Egemen Eren, Semyon Malamud 2021.

[13] As of 2019. Source: Ilzetski, Reinhart and Rogoff (2019) and IMF.

[14] Macrotrends, https://www.macrotrends.net/countries/CHN/china/imports

[15] Bank for International Settlements

[16] https://www.tradecommissioner.gc.ca/china-chine/control-controle.aspx?lang=eng

[17] Reuters, https://www.reuters.com/world/china/education-bitcoin-chinas-season-regulatory-crackdown-2021-07-27/

[18] Bloomberg News

*Basis points refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today