Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

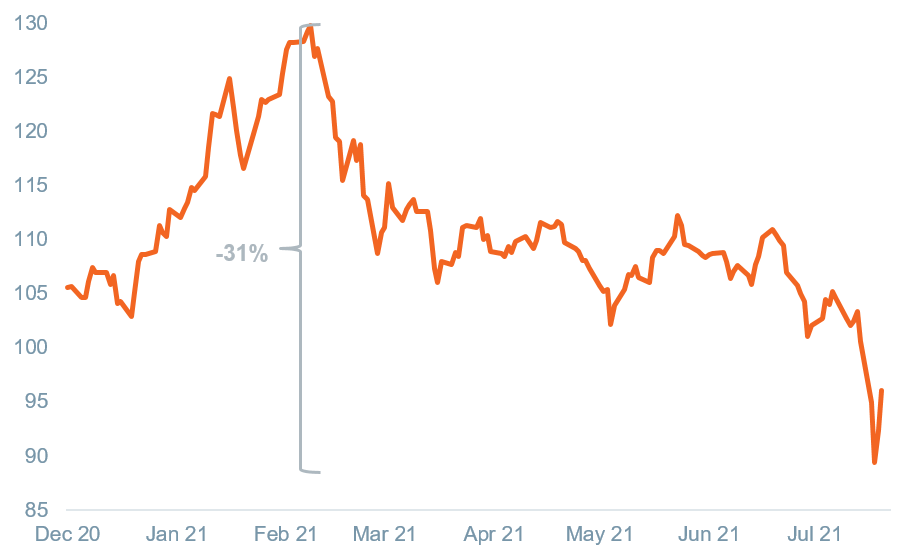

July 30, 2021—In recent weeks sweeping regulations from Chinese policymakers in several industries have rattled investors and sent Chinese equities reeling. The MSCI China Index has fallen 31% since its February peak and 11% between July 26–27 alone (Figure 1). China’s hefty weight in the MSCI Emerging Markets Equity Index—over 34%—makes it impossible for an investor to ignore (Figure 1). Yet the draconian nature and scope of regulations, particularly those pertaining to the education sector, have left experienced investors wondering if China has very quickly gone from unavoidable to uninvestable. We are closely monitoring Chinese policy risks, and below we provide a brief overview of the latest developments and our rationale for maintaining a modest overweight to emerging markets equities.

Figure 1: China’s equity market takes a hit

MSCI China Index

Data as of July 29, 2021. Source: Bloomberg.

Past performance cannot guarantee future results. Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

What has happened?

Chinese policymakers have taken steps over the last eight months to step up regulation on several companies and industries, including consumer-facing technology platforms, private education, and property developers. Alibaba, a Chinese tech company analogous to Amazon specializing in e-commerce, retail, internet, and technology, as well as other major tech-related companies, found themselves in the crosshairs first as Chinese authorities halted the IPO of Ant Financial—Alibaba’s financial technology affiliate—and followed up a few months later with a $2.8 billion fine related to anti-competitive practices. The pace and scope of regulatory scrutiny appear to be accelerating, with the most alarming displays of reach occurring in July with the conversion of all Chinese private online tutoring companies to nonprofit companies and the forced cancellation of exclusive music contracts by Tencent Holdings Ltd. Regulations on property developers have increased and are expected to continue.

Why are Chinese policymakers doing this?

We have been in constant communication with our investment partners and emerging markets managers who either have an on-the-ground presence in China or intimate knowledge of Chinese politics and corporate culture. The reasons for the shift in regulatory enforcement are complicated, and the measures being taken are even more difficult to understand. The American corporate and legal system obviously operates very differently from that of China. A deep understanding of China’s long-term goals and current challenges has never been more critical for investors.

We identify four main priorities that have led to a structural change in regulation: 1) data security, 2) competition, 3) economic opportunity, and 4) population growth. So far, all regulatory action has been tied back to these four priorities in some way, all of which are part of China’s broader long-term economic and geopolitical strategy.

We expect that China will continue to take a hard line with technology companies when it comes to data security, particularly for companies looking to raise money outside of their domestic capital markets. That was the major issue with the Chinese policymakers’ response to Didi’s U.S. initial public offering (IPO). Didi is China’s version of Uber or Lyft, and the company filed for IPO on the New York Stock Exchange in June. However, just days after listing, the Cyberspace Administration of China launched an investigation into the company’s data privacy and risk as a threat to national security. The Didi app was ordered to be removed from all Chinese app stores. Competition and antitrust are also major concerns given the size and dominance of China’s major consumer-facing technology companies, like Alibaba and Tencent.

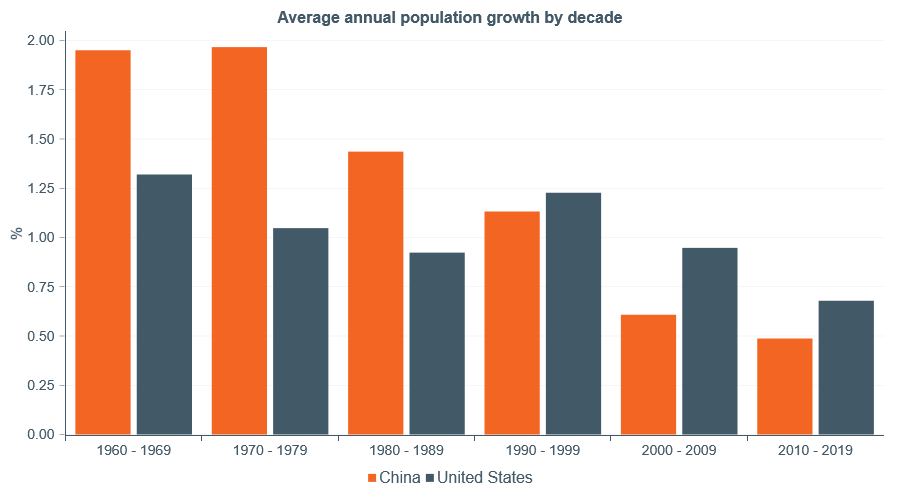

Economic opportunity and population growth are closely linked to the elevation of the middle class. China has reversed course in recent years, realizing the potential long-term damage to economic growth from their prior one-child policy, established in the 1970s (Figure 2). This policy was revised in 2016 to allow two children and, in May of this year, changed yet again to permit up to three children per family. However, the financial costs associated with raising three children are stifling population growth. The private education system in China, for example, is one in which extreme competition amongst students has led to sky-rocketing tutoring costs and an increasingly two-tiered system of upward mobility. The speculation in the property sector and the cost of homeownership is another inhibitor of population growth and of an industry facing regulatory scrutiny.

Figure 2: China aiming to reverse the population trend

As of December 31, 2019. Source: Macrobond.

How should investors weigh these risks?

While competition, data security, and economic opportunity are issues the U.S. is also grappling with, clearly, our legal system and capitalist culture result in a very different risk premium[1] for investors. An order to convert an entire industry to nonprofit is simply not a risk for U.S. companies. While some investors may be spooked by the unpredictability of recent Chinese policy actions, we would encourage investors to maintain a long-term investment horizon and stay invested in both China and emerging market equities, more broadly. We believe structural change is a major priority of China’s leaders, unlikely to reverse anytime soon, and is more likely to continue as policymakers see necessary for achieving their goals. Longer term, greater competition and growth in the middle class should support China’s economic growth and returns for investors.

In the short term, anxiety and volatility could remain elevated. However, we are avoiding selling into weakness, as we expect emerging markets equities to recover and have already seen Chinese authorities take steps to calm markets. Drastic steps from Chinese regulators certainly give off the perception that they are willing to sacrifice their equity market. We do not see that to be the case. Chinese policymakers may be shifting priorities, with structural goals outweighing the desire to attract foreign capital. However, sustained weakness in equities and investor capital flight risks China’s reputation on the global capital markets stage, its acceptance by international institutions, and the standing of its currency, the yuan. It also elevates the potential for social disruption. Instead, we believe excessive wealth, both at the corporate and personal level, along with foreign investment will be scrutinized.

Core narrative

We are retaining our modest overweight to emerging markets equities. Our exposure to emerging markets equities is largely fulfilled through actively managed strategies, which we have always found offer potentially more value-add on an after-fee basis than strategies focused on more efficient markets like large-cap equities in the U.S. or other developed markets. The recent increase in the risk premium gives active managers an opportunity to snatch up some bargains that could reap better long-term rewards while avoiding those areas of the stock market most vulnerable to tighter regulations. Emerging markets are also more than just China, and we have seen some very strong returns from other equity markets, particularly those linked to commodities. We expect an eventual receding of COVID-19 to result in a growth hand-off to emerging economies that could result in outperformance of emerging markets equities over a 9- to 12-month horizon.

[1] A risk premium is the investment return an asset is expected to yield in excess of the risk-free rate of return. An asset’s risk premium is a form of compensation for investors. It represents payment to investors for tolerating the extra risk in a given investment over that of a risk-free asset.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

The MSCI China Index measures large and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges.

The MSCI Emerging Markets Equity Index is a selection of stocks that is designed to track the financial performance of key companies in fast-growing nations.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today