Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

May 17, 2021

The economic recovery so far has been led by stimulus-fueled consumers who have opened wallets generously and pushed GDP to just 1% below pre-pandemic levels. But signs are emerging that businesses are becoming an increasingly important driver of the next leg of the rebound. A number of companies have recently announced notable plans to invest domestically in technology and manufacturing. Apple plans to spend $430 billion in over the next 5 years, Walmart $350 billion over 10 years, and Intel more than $20 billion this year, and company surveys suggest a broader trend in business plans to increase capex. In this note we explain why we expect further improvement in business capex to bolster GDP growth and productivity.

A tech-led rebound

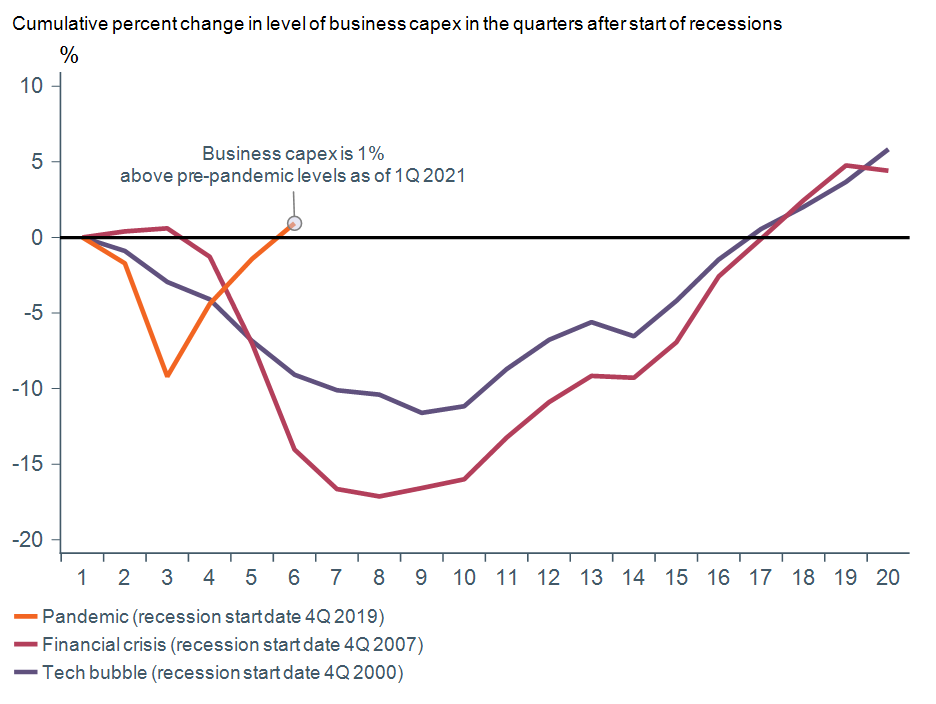

Business capex is already slightly above pre-COVID levels as of 1Q 2021 (Figure 1), just five quarters since the start of the recession (compared to an average of 11 quarters in the recessions since 1957). Typically, businesses are motivated to invest in order to meet rising consumer demand as an economy makes its way out of a recession. This time around, the recovery in capex was jump started in part by the pandemic, as firms found themselves having to spend on technology and equipment in order to quickly pivot to remote working, online shopping, streaming content, telemedicine, and other ways of adapting to survive in the new COVID environment and improve productivity given the need for social distancing.

Figure 1: Swift recovery of business capex

Data as of 1Q 2021. Sources: Macrobond, Bureau of Economic Analysis.

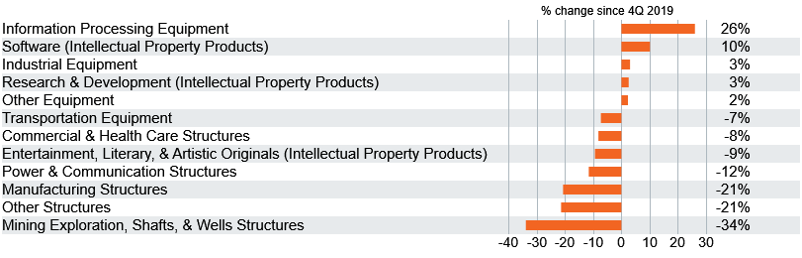

This was clear in the latest report on growth in the economy, which showed business capex on information processing equipment and software are now +26% and +10%, respectively, above pre-crisis levels. As we note in our Capital Markets Forecast (see “Accelerating Productivity”), even before the pandemic, firms were investing in Fourth Industrial Revolution technologies to increase productivity and reduce production costs. Recessions tend to accelerate trends that were already in place, and the pandemic has done so by an order of magnitude. The one area of capex that has suffered in the wake of the pandemic is capex on structures, as companies have been more hesitant to invest in buildings with rising work from home and online shopping trends keeping demand for office and retail space muted (in line with trends we note in our Capital Markets Forecast, “Who Will be Left Standing”).

Figure 2: Technology-related capex spending leading the way, while structures lag

Data as of 1Q 2021. Sources: Macrobond, Bureau of Economic Analysis.

Forward-looking plans heating up

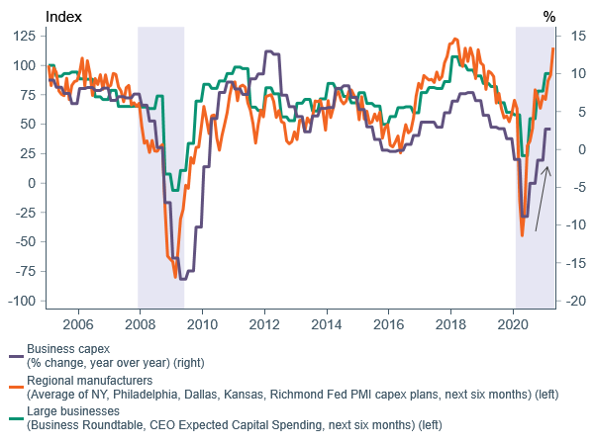

Company plans for future capex appear to be picking up (Figure 3) in response to the broader economic recovery. Surveys indicate that large companies, as well as manufacturing firms, expect to make additional capital expenditures in the months ahead. Small businesses, which were harder hit by the pandemic, appear less optimistic relative to pre-crisis sentiment, though plans for capital expenditures improved in April as the economy started to reopen.

Figure 3: Manufacturer and large-business capex plans picking up steam

Data as of 1Q 2021 (large businesses), April 2021 (regional manufacturers). Sources: Macrobond, Business Roundtable, Federal Reserve Banks of New York, Philadelphia, Dallas, Richmond, Kansas, Bureau of Economic Analysis.

Support for further capex

A number of factors remain supportive of further business capex going forward:

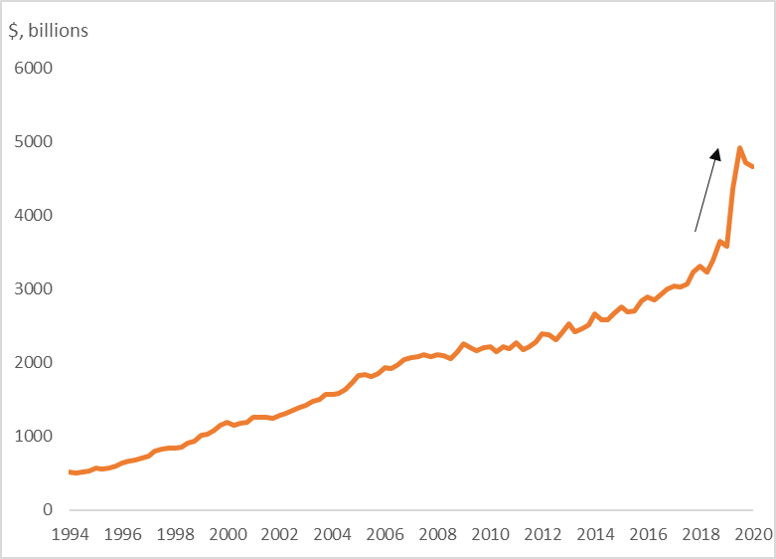

Elevated company bank balances: Firms are in a good place to expand capex thanks to large balances amassed since the start of the pandemic. Bank balances of nonfinancial businesses have surged by $951 billion relative to the pre-pandemic trend levels (Figure 4). They have been padded by stimulus funds (Paycheck Protection Program (PPP) for smaller businesses), supportive corporate credit issuance conditions (for larger firms that are able to access capital markets), and reduced travel, employment, and other expenses in the wake of the pandemic. Loan demand remains weak according to comments made by banks during their first quarter earnings calls, and the Fed’s survey of bank loan officers released in April. However, indications of soft loan demand don’t necessarily portend lower capex going forward. Firms may not be seeking loans because many already have funds needed on hand.

Loan standards loosening: The Fed’s bank loan officer survey also noted that on net, banks eased standards for commercial and industrial loans as of 2Q 2021. Though standards still remain tighter than pre-pandemic levels, easier lending conditions should be supportive of capex going forward as companies start to draw down balances and look to borrow again.

Fed policy expected to remain accommodative: We expect the Fed to keep interest rates unchanged through at least 2022 in light of its new monetary policy framework, as it looks through an expected temporary overshoot of inflation (given near-term upside pressures including base effects and supply chain disruptions).

Potential infrastructure spending: President Biden’s American Jobs Plan and American Families Plan both include a number of infrastructure spending and tax incentives to encourage development in manufacturing, clean energy, and critical industries (AI, biotech, climate science, computing, communications). This could spur new business capex in related sectors. However, both plans also include a number of proposed corporate tax increases, which could weigh on business sentiment and investment. Final details that will be important in determining the ultimate impact on the capex outlook will evolve in the coming months. They are likely to differ from the initial proposals given the Democrats’ razor thin majority in both the House and the Senate, and extensive negotiations that will need to take place to get legislation passed.

Figure 4: Nonfinancial business bank balances* have surged

*Nonfinancial bank balances are calculated as the sum of checking, currency, savings, time and money market deposits

Data as of 4Q 2020. Source: Federal Reserve.

Core narrative

We expect the rebound in business capex to be an important complement to our expectation of a recovery in consumer spending in the second half of this year, both of which should support a robust bounce in GDP growth. This is important because while consumers account for nearly 70% of GDP, business capital expenditures account for a still significant 12% of GDP. The increased productivity coming from the concentrated capex on technology should also help support the growth outlook, as rising productivity helps keep medium term inflation pressures in check despite the near-term spike in inflation. Risks to the outlook that could keep businesses more cautious in their capital expenditures include potential for higher corporate taxes, changes in global trade policies, and uncertainty about structural shifts in consumer behavior in the post-pandemic economy. But we do not currently expect them to derail the outlook for business capex. We remain constructive on risk assets, with modest overweight positions in each major equity asset class, as well as high-yield municipal bonds and commodities.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

Third party trademarks and brands are the property of their respective owners. Any reference to company names mentioned in the podcast should not be constructed as investment advice or investment recommendations of those companies.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today