Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Bitcoin’s wild ride continues, this time due to a historic breakthrough in the way investors can gain access to the cryptocurrency, namely the approval of the first U.S. spot bitcoin exchange-traded funds (ETFs). Since their launch in mid-January, Bitcoin ETFs have seen strong inflows of over $12 billion[1], which has sent the price of Bitcoin to a new all-time high (of roughly $73,500[2]). There are few investment-related topics as polarizing as cryptocurrency, and Bitcoin’s place in a diversified portfolio remains a popular topic of discussion.

There are two fundamental criteria that Bitcoin—or any currency—must satisfy to be viable. The first condition is that the currency must serve as a store of value. The second is that it must act as a medium of exchange and functional tool for commerce. In terms of the former, Bitcoin does act as a store of value, albeit at higher levels of volatility than other, more traditional currencies. As a medium of exchange, Bitcoin has yet to succeed. Despite progress in blockchain technology, such as the Lightning Network, Bitcoin has yet to be meaningfully adopted at scale.

Other risks, such as the regulatory environment and rising competition—including from Central Bank Backed Digital currencies—also cloud Bitcoin’s near-term prospects. We continue to monitor the risks and opportunities in the cryptocurrency ecosystem. Assuming Bitcoin can achieve success in the two fundamental criteria described above, we believe other challenges are potentially surmountable. While we are open-minded to investing in Bitcoin or other cryptocurrencies in a diversified portfolio at some point in the future, today we recognize that Bitcoin remains largely a speculative asset.

The bull case for Bitcoin

We remain on the crypto sidelines for now, but there is certainly some merit to the bull case for Bitcoin. The key arguments supporting the influx of capital into the asset include:

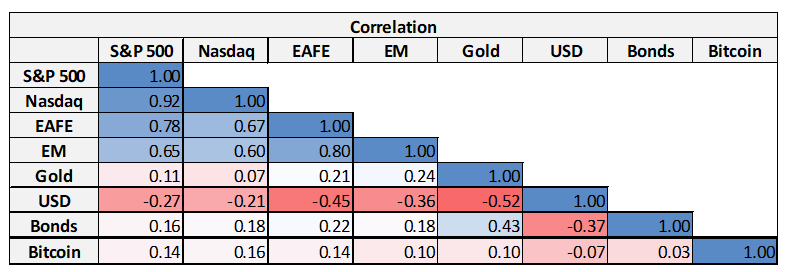

Figure 1: Asset class correlation matrix

Data as of March 4, 2024. Sources: Bloomberg, WTIA. Correlations calculated using weekly return data over the last 10 years. Bonds defined as the S&P U.S. Aggregate Bond Index.

One recent addition to the bull case for Bitcoin comes in the form of the approval of the first Bitcoin ETF—something many see as a watershed moment for cryptocurrency. Until now, the options for gaining exposure to Bitcoin were through ownership of futures ETFs, purchasing Bitcoin directly, or investing in crypto-related stocks. Bitcoin futures ETFs have traded in the U.S. since 2021 and, like most ETFs, allow individuals to gain exposure to the underlying asset without buying it directly. The downside of the futures ETF is that they are backed by derivatives of Bitcoin, rather than holding actual cryptocurrency as the underlying asset. Futures ETFs are thus subject to returns that may vary substantially from the actual price of Bitcoin, as well as leverage in the futures market and higher fees.

For those interested in owning Bitcoin directly, the process is potentially more challenging as they are required to navigate crypto trading platforms, and are responsible for storage of the digital asset. The storage process requires the user to choose among wallets connected to the internet, known as “hot wallets,” and storage on a physical device (such as a USB drive), known as a “cold wallet.” Additional complexity is involved when sending or receiving Bitcoin, as two different alphanumeric codes are generated using cryptography. The first code, typically between 26 and 35 characters, is known as the public key and allows outsiders to send cryptocurrencies to the owner’s wallet (like a home address). The private key, however, allows the owner to access their digital assets and send funds to others. Failing to properly store a private key could leave the crypto assets inaccessible or even susceptible to theft. Due to the blockchain’s immutable properties, this would make the assets unrecoverable.

The proliferation of spot Bitcoin ETFs now offers investors an inexpensive, easy, low-tracking error means of investing in Bitcoin and the cryptocurrency’s future price movements. The ETF also greatly reduces the operational complexities to owning Bitcoin, as buying the ETF does not require the individual to bear the responsibility of storage.

Still cautious on crypto

We remain skeptical on the investment merits of Bitcoin (or any other cryptocurrency at this time) in a diversified portfolio. That could change, and we are continuously analyzing the evolution, risks, and opportunities around this still-novel asset class.

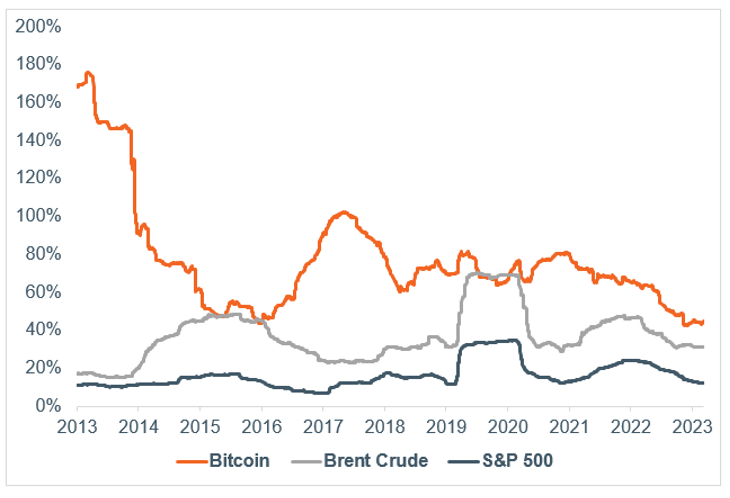

As described above, Bitcoin may technically act as a store of value, but it is very volatile. In terms of portfolio construction, it is this high-volatility profile that lies at the heart of our reticence to include the cryptocurrency in diversified portfolios. In recent years, Bitcoin’s volatility has declined significantly, but its standard deviation over the last 12 months is nearly four times that of the S&P 500 (Figure 2), and its maximum drawdown over that period is 67%, compared to only 22% for the S&P 500.

Figure 2: Bitcoin’s annualized volatility has dropped but remains almost four times higher than the volatility of the S&P 500.

Data as of March 5, 2024. Sources: Bloomberg, WTIA. Volatility calculated using the annualized standard deviation of 365 days of rolling price return data.

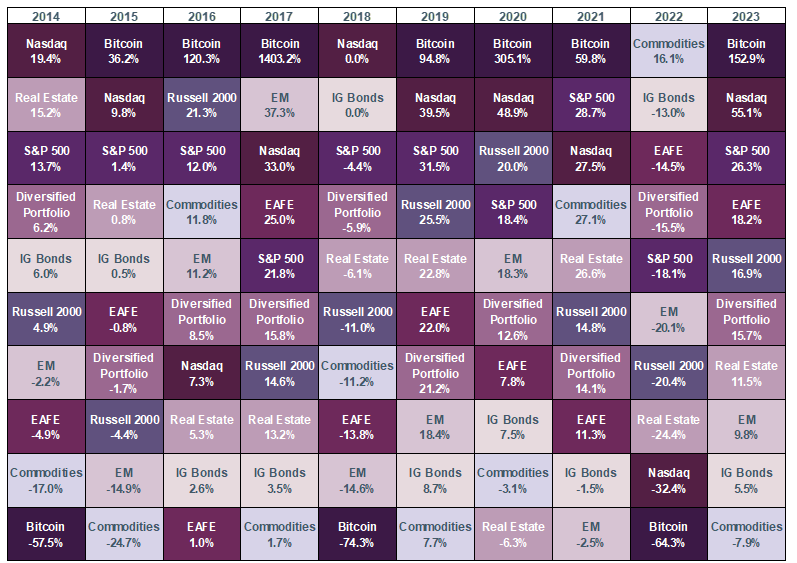

Another simple way to visualize Bitcoin’s volatility can be demonstrated below (Figure 3). In seven out of the last 10 years, Bitcoin has been the best-performing asset, but in the other three it was by far the worst performer, underperforming the next-worst asset class by as much as 40%–60% in one year. That type of return variability from one calendar year to the next necessitates a long investment horizon, and a tough stomach for volatility.

Figure 3: Bitcoin has been the best-performing asset class in seven of the last 10 years—and was the worst-performing asset class in the other three.

Data as of December 31, 2023. Sources: Bloomberg, WTIA. Diversified portfolio is constructed using the following: 35% weight in the S&P 500, 30% weight in the Bloomberg aggregate bond index, 20% weight in the MSCI ACWI ex. US, 10% weight in the Russell 2000, 3% weight in the Bloomberg commodity index, and 2% weight in global real estate. Real Estate is represented by the S&P Developed Property Index, a universe of publicly traded property companies from developed markets.

Investing involves risks, and you may incur a profit or a loss. Past performance cannot guarantee future results. Indices are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns. There is no assurance that any investment strategy will be successful.

Volatility is not Bitcoin’s only Achilles heel. Cryptocurrency is also still a fledgling asset class. While Bitcoin is the oldest and largest cryptocurrency in the world, it is still relatively young. It was invented just 16 years ago in the wake of the cratering of the global financial system—a time horizon that includes just one to two very unique economic cycles. That means we have little to go on in terms of historical data to help describe how Bitcoin is likely to interact with different asset classes and in different macroeconomic environments. For comparison, data for equities, fixed income, and commodities is available going back 100 years or more, providing a much richer data set for return analysis and projections.

Other risks include heightened regulatory scrutiny and competition from other cryptocurrencies, as well as Central Bank Digital Currencies (CBDCs), the environmental impact, and speculative investment activity.

Core narrative

The advent of Bitcoin ETFs opens a new channel for investors to gain access to Bitcoin in portfolios. We continue to evaluate the merits of including Bitcoin or other cryptocurrencies in a portfolio. At this time, we believe the risks outweigh the opportunities, and any investment in cryptocurrencies should be approached in a similar way to investing in any other highly speculative asset. Our investment process relies heavily on quantitative analysis of the economy, asset class risk, and capital market return assumptions, which help us to value securities and predict how asset classes may react and interact in various scenarios and through market cycles.

Bitcoin’s fledgling status relative to the other, more established asset classes requires a unique and still-developing set of valuation assumptions, particularly as its existence has spanned just one to two unique economic cycles. In some client portfolios, we hold indirect exposure to Bitcoin through tech companies that continue to invest in the cryptocurrency ecosystem and those that hold Bitcoin on their balance sheets. In addition, our proprietary concentrated growth portfolio, known as FIRE (Fourth Industrial Revolution Equity strategy), has exposure to a Bitcoin mining and digital asset technology company. In time, the use and investment cases for Bitcoin could become more favorable, possibly warranting a place in a diversified portfolio.

[1] Data as of March 15, 2024. Source: Bloomberg. Inflows calculated as cumulative daily fund flows for the 10 SEC approved spot-bitcoin ETFs. Calculation is net of outflows from Grayscale Bitcoin Trust.

[2] Data as of March 14, 2024. Source: Bloomberg.

[3] Data as of March 15, 2024. Source: Blockchain.com

[4] Refers to Bitcoin wallets on Blockchain.com. The total number of Bitcoin wallets is indeterminate. As of March 15, 2024. Source: Blockchain.com.

Definitions

Bloomberg Commodity Index measures the performance of 19 futures contracts on physical commodities. As of the annual reweighting of the components, no related group of commodities (for example, energy, precious metals, livestock, and grains) may constitute more than 33% of the index and no single commodity may constitute less than 2% or more than 15% of the index.

The Bloomberg U.S. Aggregate Index measures the performance of the entire U.S. market of taxable, fixed-rate, investment-grade bonds. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $250 million.

A drawdown refers to how much an investment or trading account is down from the peak before it recovers back to the peak.

The MSCI All-Country World Index ex USA (ACWI) measures the performance of large- and mid-capitalization stocks in approximately 50 developed and emerging equity markets, excluding the United States.

The MSCI EAFE® (net) Index measures the performance of approximately 20 developed equity markets, excluding those of the United States and Canada. The total returns of the index are net of the maximum tax withholding rates that apply in many countries to dividends paid to nonresident investors.

The MSCI Emerging Markets Index captures large- and mid-cap representation across 26 emerging markets countries. With 1,198 constituents, the index covers approximately 85% of the free-float-adjusted market capitalization in each country.

The Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange.

The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $1.3 billion.

The S&P Developed Property defines and measures the investable universe of publicly traded property companies domiciled in developed markets.

The S&P 500 Index measures the performance of approximately 500 widely held common stocks listed on U.S. exchanges. Most of the stocks in the index are large-capitalization U.S. issues. The index accounts for roughly 75% of the total market capitalization of all U.S. equities.

The S&P U.S. Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt.

Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance.

The U.S. dollar index (USD) is a measure of the value of the U.S. dollar relative to a basket of foreign currencies.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Any positioning information provided does not include all positions that were taken in client accounts and may not be representative of current positioning. It should not be assumed that the positions described are or will be profitable or that positions taken in the future will be profitable or will equal the performance of those described.

Wilmington Trust offers seven asset allocation models for taxable (high-net-worth) and tax-exempt (institutional) investors across five strategies reflecting a range of investment objectives and risk tolerances: Aggressive, Growth, Growth & Income, Income & Growth, and Conservative. The seven models are High-Net- Worth (HNW), HNW with Liquid Alternatives, HNW with Private Markets, HNW Tax Advantaged, Institutional, Institutional with Hedge LP, and Institutional with Private Markets. As the names imply, the strategies vary with the type and degree of exposure to hedge strategies and private market exposure, as well as with the focus on taxable or tax-exempt income.

Model Strategies may include exposure to the following asset classes: U.S. large-capitalization stocks, U.S. small-cap stocks, developed international stocks, emerging market stocks, U.S. and international real asset securities (including inflation-linked bonds and commodity-related and real estate-related securities), U.S. and international investment-grade bonds (corporate for Institutional or Tax Advantaged, municipal for other HNW), U.S. and international speculative grade (high-yield) corporate bonds and floating-rate notes, emerging markets debt, and cash equivalents. Model Strategies employing nontraditional hedge and private market investments will, naturally, carry those exposures as well. Each asset class carries a distinct set of risks, which should be reviewed and understood prior to investing.

Allocations: Each strategy group is constructed with target policy weights for each asset class. Wilmington Trust periodically adjusts the policy weights’ target allocations and may shift from the target allocations within certain ranges. Such tactical allocation adjustments are generally considered on a monthly basis in response to market conditions.

The asset classes and their current proxies are: • Large–cap U.S. stocks: Russell 1000® Index • Small–cap U.S. stocks: Russell 2000® Index • Developed international stocks: MSCI EAFE® (Net) Index • Emerging market stocks: MSCI Emerging Markets Index • U.S. inflation-linked bonds: Bloomberg US Treasury Inflation Notes TR Index Value Unhedged* • International inflation-linked bonds: Bloomberg World ex US ILB (Hedged) Index • Commodity-related securities: Bloomberg Commodity Index • U.S. REITs: S&P US REIT Index • International REITs: Dow Jones Global ex US Select RESI Index • Private markets: S&P Listed Private Equity Index • Hedge funds: HFRX Global Hedge Fund Index • U.S. taxable, investment-grade bonds: Bloomberg U.S. Aggregate Index • U.S. high-yield corporate bonds: Bloomberg U.S. Corporate High Yield Index • U.S. municipal, investment-grade bonds: S&P Municipal Bond Index • U.S. municipal high-yield bonds: 60% Bloomberg High Yield Municipal Bond Index / 40% Municipal Bond Index • International taxable, investment-grade bonds: Bloomberg Global Aggregate ex US • Emerging bond markets: Bloomberg EM USD Aggregate • Cash equivalent: 30-day U.S. Treasury bill rate.

Index Descriptions

The Bloomberg U.S. Aggregate Index measures the performance of the entire U.S. market of taxable, fixed-rate, investment-grade bonds. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $250 million.

The Bloomberg U.S. High Yield Corporate Index, formerly known as Lehman Brothers U.S. High Yield Corporate Index, measures the performance of taxable, fixed-rate bonds issued by industrial, utility, and financial companies and rated below investment grade. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $150 million.

The Bloomberg World Government Inflation-Linked Bond (WGILB) Index measures the performance of investment grade, government inflation-linked debt from 12 different developed market countries.

Bloomberg Commodity Index measures the performance of 19 futures contracts on physical commodities. As of the annual reweighting of the components, no related group of commodities (for example, energy, precious metals, livestock, and grains) may constitute more than 33% of the index and no single commodity may constitute less than 2% or more than 15% of the index.

The Dow Jones Global ex-U.S. Index is an equal-weighted stock index composed of the stocks of 150 top companies from around the world (excluding the U.S.) as selected by Dow Jones editors and based on the companies' long history of success and popularity among investors. The Global Dow is designed to reflect the global stock market and gives preferences to companies with global reach.

The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is composed of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

The MSCI All-Country World Index ex USA measures the performance of large- and mid-capitalization stocks in approximately 50 developed and emerging equity markets, excluding the United States.

The MSCI EAFE® (net) Index measures the performance of approximately 20 developed equity markets, excluding those of the United States and Canada. The total returns of the index are net of the maximum tax withholding rates that apply in many countries to dividends paid to nonresident investors.

The MSCI Emerging Markets Index captures large- and mid-cap representation across 26 emerging markets countries. With 1,198 constituents, the index covers approximately 85% of the free-float-adjusted market capitalization in each country.

Russell 1000® Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $1.3 billion.

The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $309 billion.

The S&P 500 Index measures the performance of approximately 500 widely held common stocks listed on U.S. exchanges. Most of the stocks in the index are large-capitalization U.S. issues. The index accounts for roughly 75% of the total market capitalization of all U.S. equities.

The S&P Composite Stock Price Index (noted on slide 8) refers to the data series made popular in recent years by Yale Professor Robert Shiller, not to be confused with the S&P Composite 1500, an index that combines the S&P 500, the S&P Mid Cap 400, and the S&P Small Cap 600. Investing involves risks and you may incur a profit or a loss.

The S&P Developed Property defines and measures the investable universe of publicly traded property companies domiciled in developed markets.

The S&P Municipal Bond High-Yield Index consists of bonds in the S&P Municipal Bond Index that are not rated or are rated below investment grade.

The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market.

The S&P United States REIT Index measures the investable U.S. real estate investment trust market and maintains a constituency that reflects the market’s overall composition.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today