Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

After decades of growth fueled by low interest rates and easy credit, U.S. commercial real estate (CRE) experienced a year of transition in 2023. While most sectors have been impacted by rising interest rates, inflationary pressures, and economic uncertainty over the past year, the shift to hybrid work that accelerated during the pandemic has created additional headwinds for offices—particularly Class B/C and central business district properties in major markets, such as New York City and Philadelphia. Despite these challenges, fundamentals remain strong across sectors like industrial, multifamily, and retail. Resilient consumer spending has helped to keep the retail sector steady, while a limited housing supply has supported multifamily rentals. Secular growth tailwinds, including the rise of ecommerce, have also boosted demand for industrial space. We expect investment activity to start recovering in the second half of 2024 as the Federal Reserve (Fed) moves to cut rates and the economy avoids a recession.

A non-homogeneous asset class

Capital markets activity in the CRE sector slowed across both the equity and debt markets in 2023 as the Fed’s efforts to combat inflation began to take effect. The higher cost of capital has made it difficult for buyers and sellers to agree on terms, while a lack of available credit has hurt deal flow. The industry has been focused on shoring up balance sheets and extending loans where possible, rather than making acquisitions or refinancing debt. As a result, loan originations fell 25% year over year (yoy) in the fourth quarter of 2023, led by offices (-68%), health care (-39%), and multifamily (-27%). [1] Of the office loans that matured in 2023, only a third were paid off, as most were restructured.[2] Similarly, sales activity declined 53% yoy and 33% relative to the 2017 to 2019 average.[3]

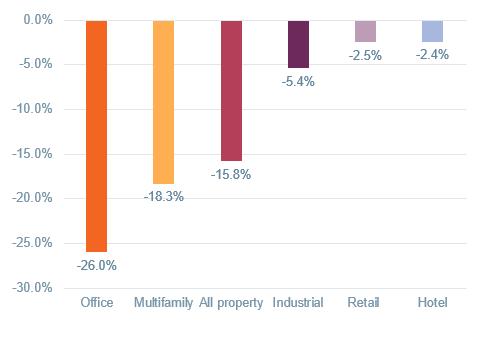

While CRE as a whole lost momentum in 2023, offices have faced the most stress due to structural headwinds unique to the asset class. Offices, for instance, have experienced the largest price declines since the 2022 peak in property valuations. (Figure 1). The outlook for the sector remains uncertain, with the national vacancy rate hitting an all-time high at nearly 20% in the fourth quarter, up from 18.4% in the third quarter, and 12.1% in 2019. [4] As hybrid work becomes more permanent, the market demand for office space has changed, with companies reducing their footprint in major cities and cheaper leases in the suburbs becoming more attractive. We have also seen a flight to quality, with Class A offices sporting modern amenities outperforming older Class B/C properties.[5]

However, vacancy rates do not tell the whole story, and occupancy data provide some indication that the market is stabilizing. The national occupancy rate, which measures the percentage of office space that is actually being utilized by workers in offices current on their lease, continues to improve. Occupancy surpassed 50% in 2023 for the first time since the start of the Covid-19 pandemic and currently sits around 52%,[6] providing an encouraging sign that vacancy rates may plateau.[7] Importantly, fundamentals differ by market, and while some central business districts may face persistent headwinds, fast-growing sunbelt cities like Miami and Charlotte have reflected strong demand for new office space and steady occupancy trends.[8]

Figure 1

CRE prices are down from 2022 peak

Offices and multifamily properties have seen the largest declines

Source: Green Street Commercial Property Price Index, CoStar Group as of December 2023.

In recent years, the multifamily sector has played an important role in helping to alleviate a U.S. shortage of single-family homes. Despite elevated supply after a surge of new construction in 2021–2022, the national vacancy rate has remained stable at around 5%. A healthy labor market, higher housing prices, and limited supply continue to drive younger families and individuals to rent. However, the delivery of 440,000 new units and more than 900,000 properties under construction will likely cause the overall vacancy rate to rise and rent growth to decelerate in 2024. Long term, a sharp slowdown in construction starts in recent quarters should help reduce supply side risk to vacancy.[9]

Unlike office and multifamily, industrial properties have been largely insulated from the broader CRE downturn, with a national vacancy rate of around 5.5%. The rapid expansion of data centers amid the digital transformation and the need for warehouse/flex space for ecommerce, particularly cold storage, have fueled record growth in the sector.[10] Manufacturing reshoring will likely be another long-term, secular tailwind as tensions with China and supply-chain challenges persist. Average lease rates continued to rise in 2023, with some markets surpassing 15% yoy growth,[11] and are expected to hit a steady run rate of 5%–6% annually over the next 10 years.[12]

The retail sector has been another bright spot in the CRE sector, supported by resilient consumption and a scarcity of new construction over the past decade. The national vacancy rate, for example, has fallen to around 4%, its lowest point in two decades.[13] Retailers have found ways to stay competitive amid the online shopping boom, which now represents 15% of all retail sales.[14] High-growth markets in sunbelt regions have also supported rent growth.[15] Similarly, the U.S. hotel industry has benefited from a resilient consumer. Despite travel activity normalizing following the post-pandemic surge in 2022, property values are near all-time highs. While hotel occupancy was flat in 2023, revenue per available room (RevPAR) rose 2.4%, driven by demand for luxury hotels.[16]

The outlook for CRE in 2024

A wall of debt coming due

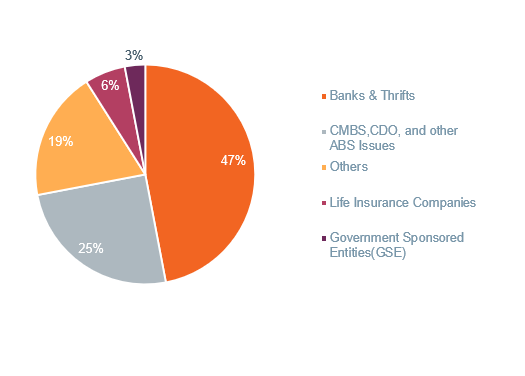

In 2024, CRE will face increasing pressure as nearly a trillion dollars in debt matures in an environment of higher rates and limited credit availability. Banks have remained cautious since the collapse of Silicon Valley Bank (SVB) last March, with nearly 40% of banks reporting that they have tightened lending standards in the most recent Senior Loan Officer Opinion Survey.[17] Overall, CRE maturities will rise to $929 billion in 2024, representing 20% of the $4.7 trillion in outstanding loans, with banks holding 47% of the maturing volume (Figure 2). The number of loans maturing this year has raised concerns about default risk and the potential for an increase in distressed assets. Delinquencies totaled $80 billion in the third quarter, an increase of $27 billion from two years prior.[18] Many loans that were expected to mature in 2023 have been extended or modified. While this has helped to limit credit losses in the near term, we expect delinquencies to rise in the coming years as loans come due.[19]

Figure 2

$929 billion in CRE loans set to mature in 2024

Banks have the greatest exposure

Source: Mortgage Bankers Association. Data as of February 2024.

Stress in the banking sector

The headlines covering the challenges for New York Community Bank (NYCB) have reignited concerns about bank CRE exposure and the health of the U.S. financial system. NYC’s rent controls have prevented property owners from raising rents to counteract the effect of higher interest rates, leaving NYCB exposed to credit risk within its $37 billion multifamily portfolio. In 2019, New York also passed the Housing Stability and Tenant Protection Act (HSTPA) of 2019, which provided additional protections for renters, including tighter restrictions around how much landlords can raise rents after making improvements. While we expect stress for some smaller banks could result in additional consolidation, such as NYCB, we believe the overall banking sector is well capitalized.

U.S. officials have acknowledged some smaller banks may be at risk, but they have reiterated that fundamentals remain firm across the banking sector. Relative to prior cycles, banks are better capitalized, credit standards have improved, and asset quality is higher. Among large-cap U.S. banks, offices represent just 4% of total loan exposure and office reserve coverage levels are over 8%. While many smaller regional banks hold a higher concentration of office assets, the median exposure is still around 4%. U.S. banks as a whole have built reserves of ~$39 billion against potential credit losses. For reference, in 2023, delinquency rates on office and multifamily were 1.5% and 0.4%, respectively, translating to a $5.5 billion loss (assuming a 50% recovery rate). Even if default rates were to reach the 6% levels we saw during the global financial crisis, banks would still be able cover their losses.[20]

Core narrative

The CRE landscape has changed significantly since the onset of the Covid-19 pandemic in 2020, with higher interest rates and weaker fundamentals in offices weighing on investment activity. While we expect the continuance of hybrid and remote work to limit office demand in the near term, performance has been stronger in sectors like retail, multifamily, and industrial. Looking to the year ahead, we expect investment activity to begin to recover as the Fed embarks on a rate-cutting cycle (first cut anticipated in June 2024) and the economy remains resilient.

While rising interest rates and a slowing economy have exposed poor risk management polices at some U.S. regional banks, we believe the broader risk to the economy is contained. Credit conditions have eased somewhat but will likely stay tight as small and mid-sized banks focus on firming up their balance sheets and reducing their exposure to lower-performing office loans. At Wilmington Trust, we believe the current market presents opportunities for CRE investors, particularly within the multifamily and industrial sectors. However, manager selection is key. We utilize a rigorous research process to identify managers across the investment universe that we believe possess the most sophisticated knowledge of individual real estate markets and are best positioned to capitalize on opportunities as they emerge.

[1]“Commercial/Multifamily Borrowing Down 25% in the Fourth Quarter of 2023,” Mortgage Bankers Association, February 12, 2024.

[2]“Commercial Real Estate and the Banks: A Zoom Doom Loop,” Empirical Research Partners, March 2024.

[3]“Capital Markets Report,” Newmark Research, 4Q 2023

[4]“What to Expect for CRE in 2024,” Commercial Property Executive, December 28, 2023.

[5]Ibid.

[6]“Kastle Systems - Data Assisting in Return to Office Plans,” Kastle, March 2024.

[7]Ibid.

[8]Lucian Alixandrescu, “Office Space Report - Vacancy and Listing Rates,” Commercial Search, March 12, 2024.

[9] “Multifamily,” CBRE, December13, 2023.

[10] “Colliers_National_Industrial_Outlook_4Q23 (1).pdf,” Colliers, Q4 2023.

[11] Steig Seaward, “Outlook 2024: Navigating Equilibrium, Distress, and Anticipated Policy Easing in Commercial Real Estate,” Colliers, December 8, 2023.

[12] “2024 Commercial Real Estate Trends,” J.P. Morgan, January 26, 2024.

[13] Thomas Lester, “Low retail vacancy leads to competitive market,” Finance and Commerce, February 20, 2024.

[14] 2024 Commercial Real Estate Trends.

[15] Steig Seaward.

[16] “U.S. hotel commentary - November 2023,” STR, December 29, 2023.

[17]“Viewpoint | Global Multi-Asset Strategy | 22-Feb-2024 (citivelocity.com),” Citi Research, February 22, 2024.

[18] Ibid.

[19] Jamie Woodwell, “Commercial Mortgage Maturities,” MBA, February 26, 2024.

[20] Jamie Woodwell, “Commercial Mortgage Maturities,” MBA, February 26, 2024.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

CFA® Institute marks are trademarks owned by the Chartered Financial Analyst® Institute.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today